Investor Relations(IR)

Integrated Report

Orico's Growth StrategyFrom a Business Perspective Settlement and Guarantee Business

To respond to a wide array of our customers' settlement and guarantee needs, we have been advancing our settlement and guarantee business through services like rent settlement guarantees and accounts receivable settlement guarantees.

| Rent Settlement Guarantees | In recent years, due to the increase in the number of single households and the rise in the utilization rate of guarantee companies, we offer various products and services to tenants and property management companies, and many are using them. |

|---|---|

| B2B Payment Services (Accounts Receivable Settlement Guarantee) |

This service, intended to eliminate the risk of non-collection, improve sales efficiency, and streamline accounting tasks, involves advancing the payment on behalf of customers who purchase the product. |

Medium- to Long-Term Vision of the Company

With the progress of digitization and the increasing complexity of economic activities, the payment needs for transactions between businesses are diversifying. In the settlement and guarantee business, we have made it our mission to sincerely address these diverse customer needs and provide comfortable and convenient payment methods. By building an environment for comfortable, safe, secure, reliable, and convenient corporate transactions and expanding credit provision to small- and medium-sized enterprises and individual business owners, we will contribute to the development of their businesses as well as risk control. This will allow us to help revitalize local economies. Additionally, we will also provide products and services that anticipate changes in society while utilizing digital technology. As we get closer to our customers and gain an understanding of their challenges, we find that there are tangible needs in areas beyond the financial services we have provided, such as business succession and real estate needs. In our relationships with customers, we will strive to become their valued partner by 2030 by taking on the challenge to provide solutions that go beyond the financial realm.

Social Issues to be Addressed through Business Activities

As the business environment becomes more challenging, many corporate clients are facing a multitude of issues.

Among them, business succession stands out as a significant challenge, especially for small- and medium-sized enterprises. Besides the aging of business leaders, due to trends in the past Japanese economy that led to hiring being suppressed, the recruitment of executive successors has been delayed, leading to a noticeable number of cases in which successor development is insufficient. Moreover, the decrease in population has made securing personnel another challenge, resulting in an increase in companies that are downsizing or restructuring their operations. At our Company, we will not merely offer financial products and services such as those available through our settlement and guarantee business. Rather, by utilizing our nationwide customer network and the expertise and networks of partners like Mizuho Financial Group and ITOCHU Corporation, we will also take on the challenge of providing optimal solutions for the myriad challenges that corporate clients face, including business succession. Through efforts such as these that transcend traditional financial boundaries, we aim to solve the issues faced by our corporate clients and contribute to the revitalization of the Japanese economy.

Medium to Long-Term Market Outlook

For the settlement and guarantee business, there are three important elements. The first is the significant change in people's behavioral patterns, such as how they buy things and work, after the COVID-19 crisis. The second is industry shakeout and reorganization gaining speed due to the emergence of small- and medium-sized enterprises experiencing trouble with business succession due to the aging population. The third consists of an increase in the cost of sustainable business growth due to increasing geopolitical risks, issues of economic security, initiatives aimed at SDGs management, and measures against cyberattacks that coincide with advances in digitization. Our Company accurately captures the impact on and needs of our customers due to these environmental changes, and we will continue to provide optimal solutions.

Features of the Business and Market Superiority

The settlement and guarantee business is a growing field with multiple digital companies excelling in statistical data analysis. That being said, the customer environment is complex and diverse, and understanding the customer through a human touch is also an assessment capability. Our Company has a market advantage in that it can discover various customer needs and respond accurately through the utilization of nationwide branches and the network of Mizuho Financial Group companies. Furthermore, by leveraging the high assessment ability cultivated in the financial business for many years, we are differentiating ourselves from other companies by responding to a diverse range of needs, ranging from large transactions to small ones.

| Strengths |

|

|---|---|

| Weaknesses |

|

| Opportunities |

|

| Threats |

|

Overview of Fiscal Year 2022

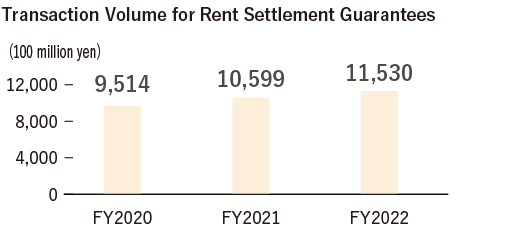

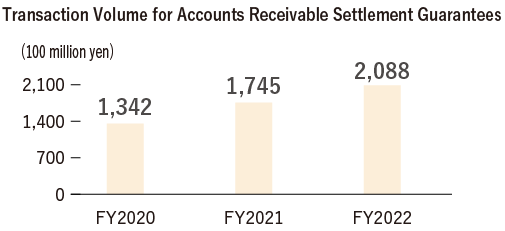

The amount of rent settlement guarantee transactions increased by 9% YoY, while accounts receivable settlement guarantee transactions also continued to grow, increasing by about 20% YoY in key industries such as fuel, building materials, and food. We will continue to support business expansion by responding to corporate settlement needs between customers and expand the market.

※ クレジットカードによる売掛金決済保証取扱高は含んでいません。

Highlights in Fiscal Year 2022

In this medium-term management plan, we have newly established a BtoB Solution Division to aim for the dramatic expansion of the settlement and guarantee business, a key market. Moreover, in establishing a market-in type of sales, we have begun providing business succession and real estate solutions to address the absence of successors, one of the most critical management issues for small- and medium-sized enterprises, as well as to respond to member merchants' entry and exit needs. We have also actively collaborated with Mizuho Bank, Ltd. to support small- and medium-sized enterprises, their clients, through the provision of accounts receivable settlement guarantee products, business cards, and support for cash flow and operational efficiency. In terms of collaboration with other companies, we have also started providing food platforms through an alliance with XMart Inc. and subsidy/grant automatic diagnosis services through an alliance with Writeup.co., Ltd. We will continue to lead our Company's growth through solutions that go beyond the realm of finance.