Sustainability

Climate Change Initiatives

Since the Paris Agreement came into effect in 2016, there has been a rapid increase in the demand for companies to address climate change risks and pursue decarbonization. We, Our Group, recognize the impact of intensified abnormal weather events, such as typhoons and heavy rainfall, and the transition to a decarbonized society as "climate change risks". As one of our key priorities, we have set the objective of "contributing to the realization of a decarbonized and circular society" and are progressing towards achieving a low-carbon and circular society by utilizing our business expertise and creating new business opportunities.

In addition to the above initiatives, we recognize the importance of climate-related financial disclosure and have expressed support for the Task Force on Climate-related Financial Disclosures (TCFD) recommendations.

The information to be disclosed in accordance with the TCFD recommendations, under the topics of "Governance", "Strategy", "Risk Management", and "Metrics and Targets", is as follows.

Disclosure of Information in Accordance with TCFD Recommendations

Governance

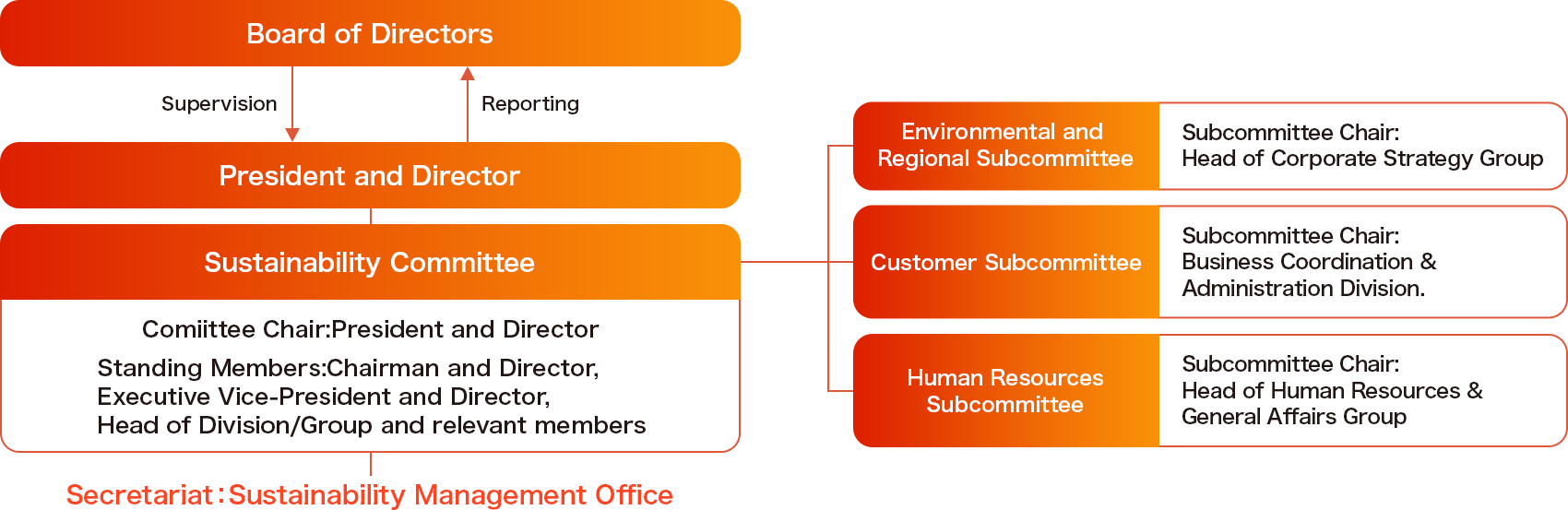

We, Our Group, have positioned “sustainability”, which aims to harmonize societal value and corporate value, as the central axis of our management operations from FY2022, and at the top of our medium-term management plan. To realize our vision for society and our company in 2030, we have identified materiality and set action items and KPIs. In April 2022, we established the Sustainability Committee chaired by our President and Director. In the Environmental and Regional Sub-Committee, a subsidiary organization of the Sustainability Committee, we discuss specific measures such as the exploration and creation of business opportunities, and the establishment of business operations systems to help reduce the burden on the environmental, with the aim of contributing to a decarbonized society and sustainable local communities through our business activities.

Moreover, the progress of our sustainability initiatives is regularly reported to the Board of Directors, and we are collectively committed to sustainability management throughout our company.

Strategy

In the Medium-Term Management Plan, we have positioned sustainability as a high-level management strategy concept that is at the heart of management. In this context, we defined materialities as critical issues that need to be prioritized in order to realize our vision and society in ten years' time, and formulated key strategies to solve these key issues using the backcasting approach. One of the materialities is "Achieving a Decarbonized and Circular Society", and we aim to contribute to solving social issues, including climate change, through the steady implementation of our key strategies.

Assessment of Management Risks and Opportunities Brought About by Climate Change

Under the framework advocated by TCFD, we have conducted scenario analyses to evaluate the potential impact on our company due to intensifying abnormal weather events such as typhoons and heavy rains and the transition to a decarbonized society.

Scope

The evaluation was conducted for consolidated subsidiaries.

Process of Assessment and Management of Climate-Related Risks, Opportunities, and Dependencies/Impacts

The Sustainability Management Office of the Corporate Planning Dept., together with related departments, 1) identified climate-related "risks and opportunities” and “dependencies and impacts”, 2) assessed them, and 3) examined countermeasures. We also collect opinions at the Environmental and Regional Subcommittee, and the Sustainability Committee deliberates upon the matter. Our management, including Officers, who are standing members of the Sustainability Committee, and Directors participate in the assessment of impacts and discussion of possible countermeasures as we promote highly effective, company-wide initiatives on climate change and other environmental issues.

Definition of Timeframes (Short-term, Medium-term, Medium to Long-term, Long-term)

Adhering to the international framework for addressing climate change based on the Paris Agreement, we have established timeframes specifying when risks are likely to occur and their potential impact, in order to ensure cohesive action. These timeframes are defined as short-term, medium-term, medium-to-long-term, and long-term as follows:

Short-term (present ~ FY2025),

medium-term (FY2026 ~ FY2030),

medium-to-long term (FY2026 ~ FY2041),

and long-term (FY2031 ~ FY2050).

Definition of Possibility of Occurrence (High, Medium, Low)

By integrating public information, expert information, and internal intelligence, we have set three levels of risk possibility: high, medium, and low. We evaluate the likelihood of occurrence by considering the progress of response measures and other factors.

High: High probability of occurrence

Medium: Possibility of occurrence but cannot be confidently predicted

Low: Low probability of occurrence

Definition of Impact Level

We, Our Group, have identified the impact level of risks and opportunities on the company's operation in financial terms, set the following categories for the definition of impact, and evaluated each risk and opportunity according to these levels. The impact values of risks and opportunities written below represent the total amounts from FY2020 to FY2030. However, we have excluded events that have yet to occur as of the calculation time in July 2023. The thresholds for the impact amounts are rounded numbers calculated based on the performance results of FY2022, considering the Tokyo Stock Exchange disclosure criteria for performance forecast revisions.

- High impact : 10% or more of total transaction volume or operating revenue, or 30% or more of ordinary profit or financial expenses

- Medium impact: 5% or more but less than 10% of total transaction volume or operating revenue, or 15% or more but less than 30% of ordinary profit or financial expenses

- Low impact: Less than 5% of total transaction volume or operating revenue, or less than 15% of ordinary profit or financial expenses

The definitions of the accounts and amounts used for the impact value, and the classification of their use, are as follows:

- Transaction Volume: The total volume of products and services handled by our company in our business activities

→ Used to indicate the impact on the business scale. - Operating Revenue: Revenue (sales) derived from primary business activities

→ Used to indicate the direct impact on our business. - Ordinary Profit: Profits earned from business activities (including profits from non-core businesses)

→ Used to indicate the impact on overall profitability or profits. - Financial expenses: Costs that change depending on the success or failure of green initiatives in raising funds from investors, financial institutions, and other external sources

→ Used to indicate investors' evaluation of our environmental and other initiatives.

| Transaction Volume | Operating Revenue | Ordinary Profit | Financial Expenses | |

|---|---|---|---|---|

| High | Over 600 billion yen | Over 20 billion yen | Over 7 billion yen | Over 3 billion yen |

| Medium | From 300 billion yen to less than 600 billion yen | From 10 billion yen to less than 20 billion yen | From 3.5 billion yen to less than 7 billion yen | From 15 billion yen to less than 3 billion yen |

| Low | Less than 300 billion yen | Less than 10 billion yen | Less than 3.5 billion yen | Less than 1.5 billion yen |

Scenarios Used in Analysis

To accurately understand the impact of climate change on our business to the greatest extent possible, we used the following two scenarios:

- 1.5℃ Scenario: This scenario limits the temperature rise by the end of the 21st century to about 1.5℃ compared to pre-industrial revolution levels. It anticipates the emergence of risks and opportunities associated with the transition to a carbon-neutral society, such as tighter GHG emissions regulations and the shift from gasoline-powered vehicles to electric vehicles (EVs).

- 4℃ Scenario: This scenario anticipates a temperature rise of about 4℃ by the end of the 21st century compared to pre-industrial revolution levels. It predicts an increase in severe disasters due to sea-level rise and abnormal weather conditions.

We have used the 1.5℃ scenario as the basis for risk and opportunity analysis and set reduction targets aimed at achieving carbon neutrality by 2050. However, for ""Business continuity risk due to increased abnormal weather conditions, such as typhoons and heavy rains (physical risk)""under risks and opportunities, we have adopted the 4℃ scenario to analyze and calculate impact values in preparation for the worst-case scenario.

Recognition of Climate-Related Risks and Opportunities

As a disclosure item related to the TCFD recommendations, we have identified climate-related risks and opportunities for our company.

As a result of this evaluation, the risks and opportunities identified as impacting our business are listed in the table below.

List of identified risks and opportunities

Scenario |

Category |

Changes in Externalities |

Timeframe |

Possibility of Occurrence |

Orico's Risks & Opportunities |

Total Impact Value (Sum Within The Period) |

Level of Impact |

Countermeasures |

|---|---|---|---|---|---|---|---|---|

| Used Gasoline Cars Risk | Transition Risk | Regulatory and consumer preference changes will drive a shift to EVs, shrinking the market for new and used gasoline-powered vehicles | Medium-to-long-term | High | Decrease in volume of autoloans for used gasoline-powered vehicles | Transaction Volume Approx. -130 billion yen |

Low | Expansion of transaction volumes for new EVs, overseas EVs, and EV leasing Formation of a suitable second-hand EV market through initiatives like MOBI |

| Increased Financing Expenses Due to Delays in Sustainability Initiatives | Transition Risk | Increasing demand for green social aspects from institutional investors and others will increase the importance of sustainable finance | Medium-term | Medium | Higher financing costs due to the deterioration of our image and reputation for handling autoloans for gasoline-powered vehicles | Financial expenses Approx. -4.5 billion yen |

High | Continue to implement ESG financing Publicize our high level of ESG awareness and initiatives in various disclosures |

| Introduction of Carbon Tax | Transition Risk | Government policy to become carbon neutral (net zero) by 2050 will lead to further carbon taxation | Medium-to-long-term | Medium | Increased business costs due to the introduction of the carbon tax | Ordinary Profit Approx. -1.5 billion yen |

Low | Reduction of energy emissions Introduction of renewable energy Installation of high-efficiency energy-saving equipment Purchase of certificates and credit |

| Business Continuity Risk Due to Increased Extreme Weather Such as Typhoons and Heavy Rain | Physical Risk | Increased risk of business continuity due to frequent disasters such as typhoons, floods, and other similar events

|

Medium-to-long-term | Low | Increased business continuity risk in the event of a power outage at our data center | Operating revenue -500 million yen (Assuming 1 day down Approx.) |

Low | Support for business continuity during disasters |

| Formation of the Used EV Market | Opportunity (Market) | Appropriate valuation of used EVs (market formation) and increased EV ownership (change in consumer behavior) | Medium-to-long-term | High | Establishment of EV battery valuation method and correct evaluation of the value of used EVs will lead to an influx of EVs into the used car market, in which we have a large market share, and increase our transaction volume both in Japan and overseas | - | - | Formation of a suitable second-hand EV market through initiatives like MOBI |

| Ethical Shift | Opportunity (Market) | Trends in regulatory authorities and consumer awareness and behavior become more environmentally and socially conscious, creating momentum for ethical consumption | Medium-to-long-term | Medium | A shift in consumer awareness toward environmentally and ethically conscious products has increased demand for products and services such as solar power generation, V2H, and social contribution cards, leading to an increase in our transaction volume | Transaction Volume Approx. +870 billion yen |

High | Fulfilling needs for environmentally friendly products (both in credit provision and sales) Differentiation of our products (sales of set environmentally friendly products) Expansion of partnerships for social contribution cards |

| Reduction of Financing Expenses through Enhanced Sustainability Measures | Opportunity (Market) | Increased importance of sustainable finance due to growing demand for green social aspects from consumers, financial institutions, and institutional investors | Medium-term | High | Increased potential for lower financing costs through new financing instruments such as sustainability-linked loans/bonds in response to the expansion of ESG investments | Financial expenses Approx. -100 million yen |

Low | Establish KPIs that are valued by investors Improvement of ESG ratings |

| Disaster Prevention and Mitigation Demand | Opportunity (Market) | Increased demand for financing for disaster prevention and mitigation due to increased disasters such as typhoons, floods, and other similar events | Medium-to-long-term | Medium | Increased demand related to disaster prevention and mitigation, increasing opportunities for our support Increased disaster resilience of our stakeholders and our business continuity |

Transaction Volume Approx. +150 billion yen |

Low | Prompt response to the demand for funds for disaster prevention, mitigation, and recovery Collaboration with local governments on disaster prevention and mitigation |

- *The impact value of risks and opportunities is reported as the total from FY2020 to FY2031. However, events that have yet to occur as of the calculation time, July 2023, are excluded from the calculation.

- *Regarding “Formation of the Used EV Market”, we have not calculated the impact value for this analysis.

Risk Management

We, Our Group, have established a "Risk Management Basic Policy" to comprehensively understand and manage various risks within the group. Divisions and Groups in charge are entrusted with managing individual risks, while the Risk Management Group oversees the overall management of these risks. To ensure effective control, we has established various committees, including the Comprehensive Risk Management Committee, that monitor and evaluate risks at the management level. The status of risk management across the entire Orico group is regularly reported to the Board of Directors and discussed in Executive Management Meetings.

Climate-related Risk Management

We recognize that the impact of business continuity risks is limited, as we do not hold any business interests directly affected by climate change, and have established business continuity plans and conducted BCP training anticipating emergencies such as large-scale disasters.

However, in light of the impacts of climate change on our business and society, as well as the rapidly accelerating efforts in policy and industry, we recognize “the impact on business due to the introduction/change of new regulations related to climate change” as a serious risk. Therefore, we have selected it as one of our top risks, intensified monitoring, and are reporting management conditions to the Board of Directors.

Indicators and Targets

Based on the TCFD recommendations, we are quantifying Scope 1, Scope 2, and Scope 3 emissions as indicators contributing to our understanding of climate-related risks and opportunities. The emissions for the past three years are as follows:

We will continue our reduction efforts to achieve net zero emissions in 2050, with the goal of achieving the 1.5℃ target of the Paris Agreement.

unit:t-CO2

| Items | Emissions in each year | |||

|---|---|---|---|---|

| FY20 | FY21 | FY22 | FY23 | |

| Scope 1 | 4,246 | 4,549 | 4,869 | 4,745 |

| Scope 2(Market-Based*1) | 11,647 | 11,506 | 10,709 | 8,956 |

| Scope 2(Location-Based*2) | 11,614 | 11,160 | 10,092 | 9,803 |

| Scope 1& 2(Market-Based*1) | 15,893 | 16,055 | 15,579 | 13,701 |

| Scope 1& 2(Location-Based*2) | 15,860 | 15,709 | 14,961 | 14,548 |

| Scope 3 Category 1(Purchased Goods and Services) | 6,623 | 5,196 | 4,790 | 4,545 |

| Scope 3 Category 3(Not Included in Scope 1 or 2) | 2,361 | 2,279 | 2,065 | 2,735 |

| Scope 3 Category 4(Upstream Transportation and Distribution) | 299 | 449 | 459 | 448 |

| Scope 3 Category 5(Waste Generated in Operations) | 86 | 83 | 85 | 97 |

| Scope 3 Category 6(Business Travel) | 1,200 | 1,152 | 1,124 | 1,188 |

| Scope 3 Category 7(Employee Commuting) | 2,296 | 1,953 | 2,116 | 2,367 |

| Scope 3 Category 11(Use of Sold Products) | 537 | 731 | 467 | 614 |

| Scope 3 Category 13(Downstream Leased Assets) | 180,410 | 0 | 0 | 103,705 |

| Scope 3 Total | 193,812 | 11,843 | 11,107 | 115,699 |

| Total | 209,705 | 27,897 | 26,685 | 129,400 |

Reduction Targets

unit:t-CO2

| Short-Term Target | Intermediate Target | |||

|---|---|---|---|---|

| FY27 Reduction Targets | Against FY20 | FY30 Reduction Targets | Against FY20 | |

| Scope 1 + Scope 2 (Market-Based*1) |

11,221 | 29.4% reduction | 9,218 | 42% reduction |

| Scope 3 | 159,895 | 17.5% reduction | 145,359 | 25% reduction |

- *1: Emissions calculated by applying the emission factors of electric power companies. However, for the emissions of domestic and foreign consolidated subsidiaries, the calculation was based on the location-based approach described below.

- *2: Emissions calculated based on emission factors for the entire power system in Japan. For overseas subsidiaries (Thailand, the Philippines and Indonesia), figures published by IGES (Institute for Global Environmental Strategies) and the Indonesian Government were used.

- Note: The scope of calculation covers our consolidated subsidiaries. The emissions of Orico Auto Leasing Co. ,Ltd. and Orico Business Leasing Co. ,Ltd. , which became consolidated subsidiaries after October 2023, are included in Scope 1, 2, and 3 for the base year FY2020 and the second half of FY2023 respectively, in accordance with the GHG Protocol. GHG emissions for FY2021, FY2022, and the first half of FY2023 do not include the two subsidiaries that were not consolidated during these periods.

Assurance Report

To ensure the accuracy and transparency of our energy consumption and CO2 emissions data, our group have Independent Assurance Report from an independent third-party organization, SOCOTEC Certification Japan.

Area of Coverage : Scope1・2(consolidated group)and Scope3 category4・6・7(non-consolidated)

Sustainability

-

Sustainability Management

- Sustainability Management

- In this page, we introduce our sustainability management, the sustainability basic policy, materiality and other information.

-

Value Creation Process

- Value Creation Process

- This page introduces our Value Creation Process.

-

ESG Information

- ESG Information

- This page is a directory of our Environmental, Social and Governance (ESG) information. This page provides intuitive navigation to the information you are looking for on our sustainability management initiatives.

-

Social contribution activities

- Social contribution activities

- Here, we introduce our approach to social contribution and the results of our activities.

-

ESG Data

- ESG Data

- This page provides a range of ESG data on our sustainability management performance.

-

External Recognition

- External Recognition

- This page presents an external evaluation on our sustainability management initiatives.