Sustainability

Sustainability Management

Orico's Sustainability Statement, promotion system, materiality, etc.

Orico's Sustainability Statement

We, Orico, are committed to our corporate purpose: "Open the future with you". This represents our determination to be a partner, taking a genuine care and leading with enthusiasm, staying close to the present and the future status of each one of our stakeholders.

Our goal is to create a sustainable society in which everyone can realize a fulfilling life. We seek to solve various social challenges through the power of innovation and pass on a legacy of such a society to future generations.

To this end, as a trusted partner, we pursue both social value and corporate value by contributing to society through all of our corporate activities.

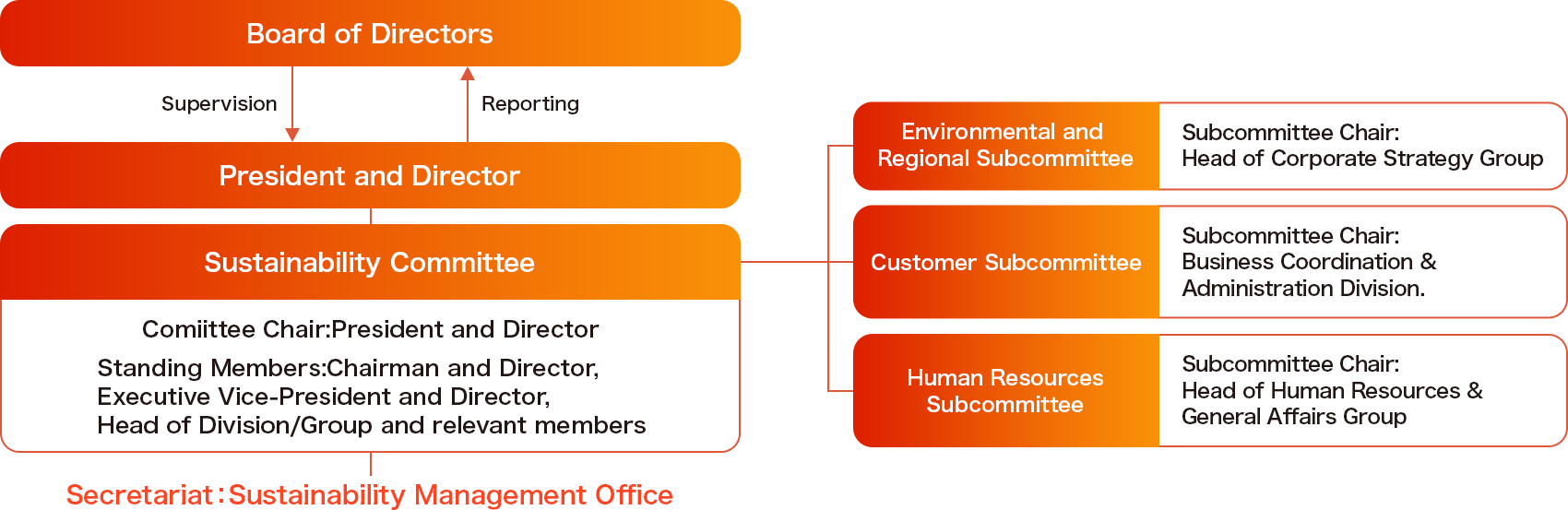

Sustainability Management Structure

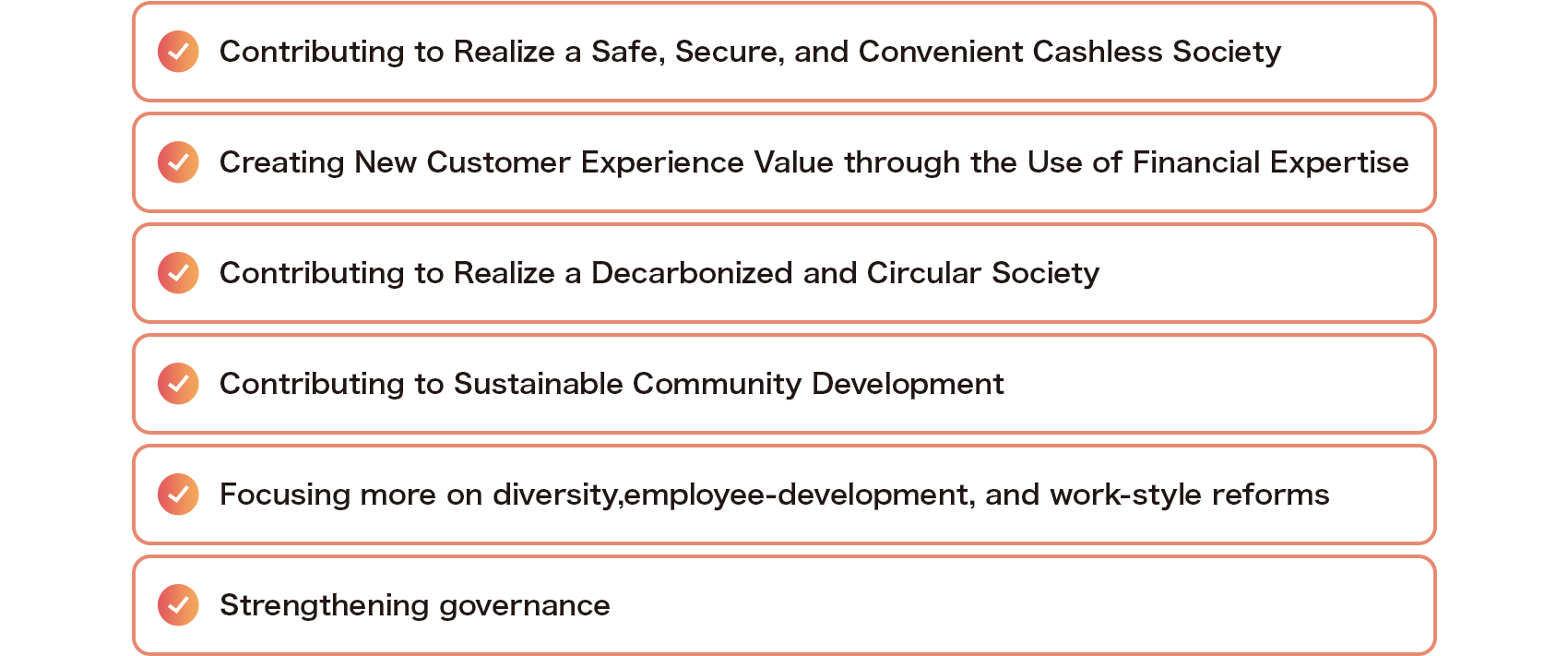

Materialities

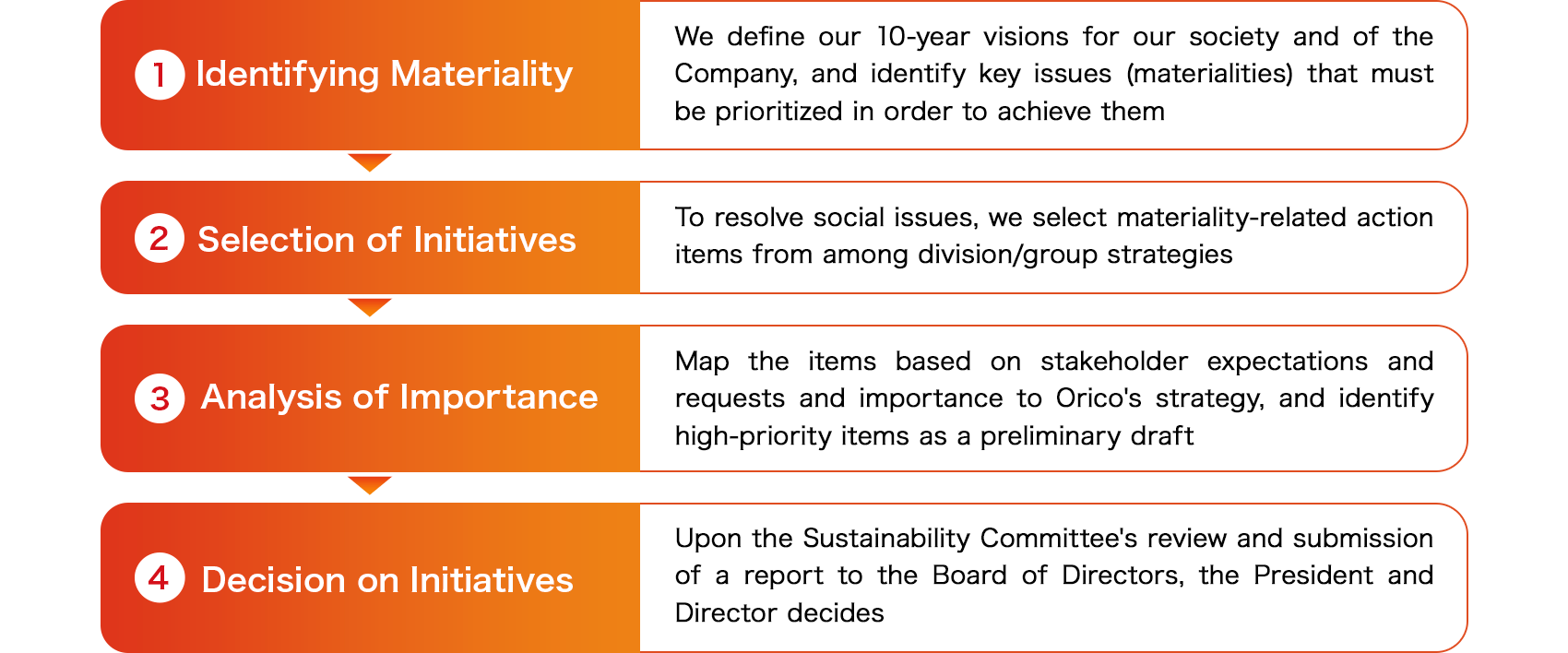

The Process of Identifying Sustainability Initiatives

Our Company has established specific initiatives and KPIs in con junction with the medium-term management plan to address social issues through our business activities and to achieve our materiality, as outlined in the following process.

By advancing these initiatives, we are striving to generate new businesses that contribute to solving social issues and to drive organizational transformation, thereby achieving a balance between social and corporate value.

Sustainability Initiatives and Targets for FY2022-2024

We aim to create social value and enhance corporate value by solving various issues using the PDCA (Plan-Do-Check-Act) cycle, which sets specific initiatives, targets, and KPIs for each materiality.

- Contributing to the realization of a safe, secure, and convenient cashless society

- Creating new customer experience value through the use of financial know-how

- Contributing to a Decarbonized Society and Circular Economy

- Contributing to Sustainable Community Development

- Diversifying human resources and reforming work style

- Strengthening Governance

Contributing to the realization of a safe, secure, and convenient cashless society

| Initiatives | Key Performance Indicators (targeting March 2025) |

Social Value/ Corporate Value Targets | Results and Initiatives in FY2023 |

|---|---|---|---|

|

Expanding the use of credit cards

|

Expand card shopping transaction volume to 3.3 trillion yen to achieve a cashless ratio of 40% in Japan by 2025

|

Contribute to consumer convenience by promoting cashless payment through increased use of credit cards |

Results Initiatives |

|

Expand use of business cards

|

Strengthen promotion of business cards and loan products that meet customer needs | Contribute to improving the productivity of small and medium-sized enterprises and sole proprietors by promoting cashless payment in the business field. |

Expanded the use of business cards among companies by promoting the Orico Business Payment for SME. |

|

Provide new cashless payment services

|

|

Through the development of new products and services, provide a variety of cashless means of payment and contribute to further convenience. |

Introduced digital cards, which customers can apply and use on their smartphones, and Orico Code Payment and newly digital payment services to be available at credit card member merchants. |

|

Strengthen information security measures

|

Strengthen measures against credit card fraud by introducing new tools utilizing digital technology. | Provide an environment where everyone can use payment services safely |

|

Creating new customer experience value through the use of financial know-how

| Initiatives | Key Performance Indicators (targeting March 2025) |

Social Value/ Corporate Value Targets | Results and Initiatives in FY2023 |

|---|---|---|---|

|

Automation of asessment operations

|

Double the rate of fully automated reception and screening operations to provide high quality services and improve customer convenience

|

Improve customer convenience, provide high-quality services, and increase productivity by promoting automation of business operations. |

Results Initiatives |

|

Provide customer experience value through the use of digital technology.

|

|

Provide new experience value by developing innovative solutions utilizing digital technology |

Launched several services through the digitization of new services and existing businesses. |

|

Creation of new business models for ethical consumption

|

Develop a platform business on the theme of ethical consumption, including the environment. | Develop a platform business to promote ethical consumption and support consumers' efforts to solve social issues. |

Continue to communicate with ethical-related business operators. |

|

Develop new financial services in collaboration with financial institutions

|

Develop financial services through the use of AI and collaboration with fintech companies, etc. (data mining, personal loan matching, immediate screening) | Provide an environment where customers can easily select and use the most appropriate financial products through the development of new services |

Provided services that help respond to needs from financial institutions or solve community problems (business outsourcing, personnel recruitment support, among others) in collaboration with business partners. |

|

Digitalization of auto loans in Southeast Asia

|

Develop DX and digital strategies with a focus on future markets | Developing innovative applications using digital technology and shortening the time required for screening to improve convenience for customers and provide high-quality services. |

Embark on the development of system platforms for digitization such as the development of applications and the introduction of credit scoring models. |

|

Enhance Customer Experience—Implement Initiatives Based on the Voice of Customer

|

* Initiatives were revised in November 2023. |

Improve the relationship of trust with customers by enhancing the value of the customer experience in a variety of situations. |

|

|

Support for improving literacy among young people, the elderly, and people with disabilities

|

|

Contribute to building a society where everyone has correct knowledge about money and can use financial services with peace of mind |

|

|

Continuous implementation of ESG procurement

|

|

Promote ESG procurement with the aim of contributing to the achievement of the SDGs, and provide products and services to customers on an ongoing basis |

|

Contributing to a Decarbonized Society and Circular Economy

| Initiatives | Key Performance Indicators (targeting March 2025) |

Social value/corporate value Targets | Results and Initiatives in FY2023 |

|---|---|---|---|

|

Reduction of greenhouse gas emissions and energy usage in business operations

|

|

Contributing to a decarbonized society through the reduction of greenhouse gas emissions and energy usage. |

Results

Initiatives

|

|

Promoting a paperless business operation

|

|

By promoting the efficient utilization of limited resources throughout the Orient Group, we contribute to a circular economy/society |

Results Initiatives |

|

Expansion of EV and Promotion of Environmental Products

|

|

By promoting environmentally friendly products through financial services, we contribute to realizing a decarbonized and circular society. |

|

|

Contributing to the development of the EV market in Southeast Asia

|

Research remains underway on the trends and prospects of the EV market in the entire Southeast Asia. |

Contributing to Sustainable Community Development

| Initiatives | Details and Key Performance Indicators (targeting March 2025) |

Social Value/Corporate Value Targets | Results and Initiatives in FY2023 |

|---|---|---|---|

|

Using our expertise to provide financial products in Southeast Asia

|

Expansion of auto loan business

* KPIs were revised in line with changes in the business plan in April 2024.) |

By providing tailored services for each country, we contribute to the development of the automotive market in Southeast Asia. |

|

|

Expanding credit provision to small and medium-sized enterprises (SMEs) and individual business owners.

|

Expanding Accounts Receivable Settlement Guarantee Business

To further enhance the credit intermediation function in the local community, expand the transaction volume of accounts receivable settlement guarantees to 300 billion yen. |

By providing a secure business transaction environment, we contribute to the revitalization of the local economy through support for SMEs and individual business owners. |

Results Initiatives |

|

Providing sustainable products through collaboration with regional financial institutions.

|

Developing sustainable products in collaboration with financial institutions (such as decarbonization-focused multipurpose loans). Partnering with more than 10 financial institutions to develop sustainable products that contribute to solving regional challenges. |

We contribute to regional revitalization by offering financial products and services tailored to local challenges. |

Results Initiatives |

|

Revitalizing the local economy through support for SMEs and individual business owners through financial products.

|

|

By offering services that provide credit and business support to SMEs, we support the revitalization of the local economy. |

|

|

Providing secure housing options.

|

Expanding the rental guarantee business

|

We support the provision of secure housing not only in urban areas but also in rural areas, contributing to community development and regional revitalization. |

|

|

Supporting regional revitalization through utilizing our company's resources.

|

Engaging in dialogue and collaboration with local governments through utilizing our leasing resources, including financial expertise, products, and services. | By partnering with local governments through the provision of our company's resources, we aim to address regional challenges |

Concluded a comprehensive partnership agreement with Funabashi City in Chiba Prefecture and a partnership agreement with Fujimi City in Saitama Prefecture. |

Diversifying human resources and reforming work style

| Initiatives | Details and Key Performance Indicators (targeting March 2025) |

Social value/corporate value Targets | Results and Initiatives in FY2023 |

|---|---|---|---|

|

Creating an environment where diverse talents can thrive.

|

Raising awareness among manager candidates We aim to promote the active participation of women and create an organization where diverse talents with unique characteristics can thrive.

* KPIs for March 2025 were revised upward in April 2024. |

By promoting initiatives that leverage diversity, we will create an environment where each employee can work enthusiastically and thrive. |

Results

Initiatives Deepened employee understanding through inclusion and diversity training programs. |

|

Promotion of paternity leave uptake among men. We continue to strive for a society where work-life balance is achievable for both men and women, aiming for a 100% paternity leave uptake among men. |

Results Initiatives |

||

|

Utilizing surveys to enhance employee engagement. Improvement of Employee Engagement Score to BBB level. |

Results Initiatives |

||

|

Expanding support measures for autonomous career development that cater to each employee's drive to grow

|

Meeting employees' drive to grow by expanding opportunities

Over 3 years, 200 employees have participated in new experiential programs both within and outside the company, including side jobs and trainee positions in startup companies. |

Through the provision of diverse learning opportunities and platforms, we will foster employees who can excel in various situations. |

Results Initiatives |

|

Expanding talent with DX skills (Promoting DX personnel).

Expanding talent with DX skills (DX promotion personnel) to 3,000 individuals. |

Results Initiatives |

||

|

Enhancing educational content. Deploying initiatives to provide learning opportunities |

Provided e-learning “Udemy Business” to all full-time employees to promote autonomous learning. Provided several kinds of educational content to help them acquire various other knowledge and skills and form their own career autonomously. |

||

|

Promoting Work-Life Balance

|

Optimizing total working hours through initiatives such as improving the rate of taking paid vacations. Achieving a paid vacation utilization rate of 70% or higher to establish a work-life balance. |

We promote a work style that emphasizes a healthy balance which will enhance employee satisfaction and improve productivity. |

Results Initiatives |

|

Initiatives on Human Rights Due Diligence

|

Implementing training programs on promoting human rights awareness in the workplace. | Through human rights education, we recognize the fundamental social responsibility in our business activities and conduct our operations with consideration for human rights. |

|

Strengthening Governance

| Initiatives | Details and Key Performance Indicators (targeting March 2025)) |

Social value/corporate value Targets | Results and Initiatives in FY2023 |

|---|---|---|---|

|

Establishing the Operation of Risk Appetite Framework

|

|

Through further improvement of the governance framework, we aim to achieve sustainable growth and long-term improvement in corporate value. |

|

|

Initiatives for Improving ESG Evaluation

|

|

|

|

|

Establishing and Improving Compliance System

|

|

|

Sustainability Report

This section contains information on our basic approach to sustainability, our initiatives, and our future direction.

Integrated Report has been issued since FY2023.

Sustainability

-

Sustainability Management

- Sustainability Management

- In this page, we introduce our sustainability management, the sustainability basic policy, materiality and other information.

-

Value Creation Process

- Value Creation Process

- This page introduces our Value Creation Process.

-

ESG Information

- ESG Information

- This page is a directory of our Environmental, Social and Governance (ESG) information. This page provides intuitive navigation to the information you are looking for on our sustainability management initiatives.

-

Social contribution activities

- Social contribution activities

- Here, we introduce our approach to social contribution and the results of our activities.

-

ESG Data

- ESG Data

- This page provides a range of ESG data on our sustainability management performance.

-

External Recognition

- External Recognition

- This page presents an external evaluation on our sustainability management initiatives.