Sustainability

Community Investment

To date, through financial and settlement services, we have grown in tandem with the development of local economies where our customers and business partners live. In Japan, we operate nationwide and work with local small and medium enterprises (SMEs) and other business partners to build sustainable businesses, while overseas, we encourage growth in local economies. Therefore, the sustainable development of local communities is essential to our growth, and we have identified “contributing to sustainable community development" as one of our materialities (key issues). To achieve this, we have designated activities that contribute to local communities, support the next generation, and social contribution activities by employees as priority areas where we will focus our efforts.

We will continue collaborating with local governments, educational and academic institutions, business partners, and other stakeholders to “contributing to sustainable community development" as a reliable local partner by utilizing our financial products, services, and network.

- *The page below shows an independent third-party assurance report by Ernst & Young ShinNihon LLC and related information on our sustainability-linked finance (loans/bonds) which uses a transaction value of auto loans in Southeast Asia as a KPI: Sustainability Linked Finance

Aims and Commitments of Community Investments

Business Strategic Aims of Community Investment Focus Areas and Activities

- Contributions to Local Communities

Our aspiration for the next decade is to be a company that is more than ever recognized by its stakeholders for its significance in society. We understand that being indispensable to the local community is vital to our business's sustainability. To achieve this, we are committed to developing and providing market-oriented products and services and enhancing our brand image by actively contributing to the local communities.

- Support for the Next Generation

Our financial settlement services are lifelines in daily lives and an essential tool in working lives for our stakeholders. Recently, however, financial crimes targeting young people, such as those who have reached adulthood, have become rampant. For us, the healthy growth of the irreplaceable next generation, our future customers, is essential for the sustainable enhancement of our corporate value. Therefore, we have made support for the next generation a priority area.

- Social Contribution Initiatives by Employees

Participation in social contribution initiatives as a community member is an essential opportunity for us and our employees to learn from the community and develop and provide market-oriented products and services that the community will always need. It is also an essential part of our business strategy as we can expect a return on our investment in improving our brand image.

Our Commitment to Community Revitalization and Job Creation

We are committed to revitalizing local economies, creating jobs, and local employment, as well as developing our business partners, including member merchants, alliance partners, contractors, and suppliers of goods and services. We have offices in all 47 prefectures of Japan, bringing our total number of offices to 106. We have three overseas group companies in Thailand, the Philippines, and Indonesia. We make significant contributions to job creation and local employment in Japan and abroad. We believe that our “contributing to sustainable community development" efforts are also crucial as activities that lead to job creation, local employment, and local revitalization.

Contributions to Local Communities

Partnership with Local Municipalities

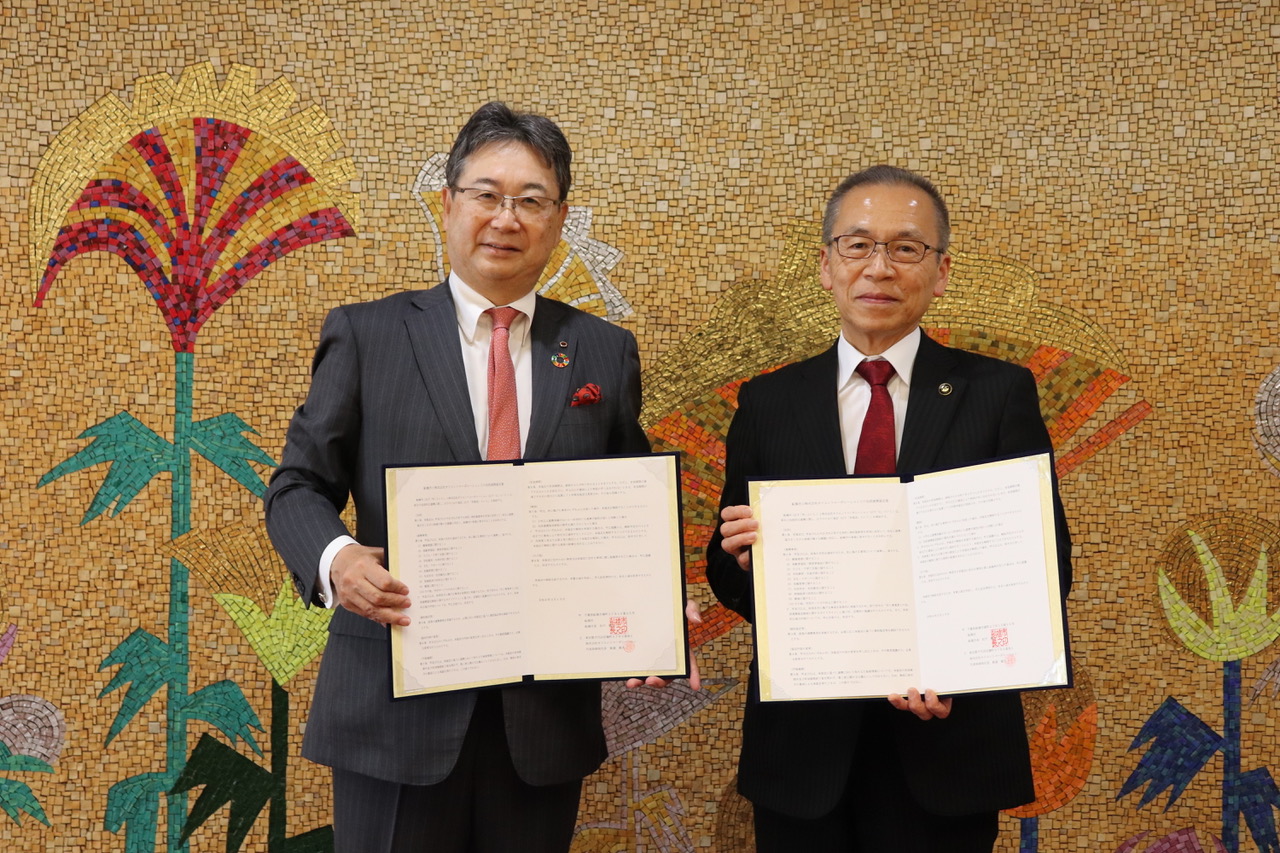

Execution of “Comprehensive Partnership Agreement” with Funabashi City, Chiba Prefecture

On March 19, 2024, we have entered into a “comprehensive partnership agreement” with Funabashi City, Chiba Prefecture. We are committed to contributing to the resolution of various issues facing Funabashi City by leveraging the Orico Group’s financial services and network capabilities. We will further promote initiatives to contribute to regional revitalization and development including this comprehensive partnership agreement.

(Left) Tetsuo Iimori,President and Representative Director of Orico

(Right) Toru Matsudo, Mayor of Funabashi City

Individual Collaboration Agreement

Agreement with Chiyoda Ward on Accepting People Who Have Difficulty Returning Home

On October 24, 2017, we concluded an agreement with Chiyoda Ward to accept people who would have difficulty returning home in the event of a large-scale disaster. In a disaster, we will accept people with difficulty returning home as temporary accommodation for around 72 hours, providing them with food, water, blankets, toilets, among others.

Certification of “Certified Eco Business Site” of Nagoya City, Aichi Prefecture and Registration with “NAGOYA SDGs PLATFORM”

On February 29, 2024, Orico’s Nagoya Branch received certification of a “certified eco business site”as “Nagoya SDGs Green Partners” from Nagoya City. In addition, the branch was registered with the “NAGOYA SDGs PLATFORM” for the purposes such as communicating information on SDGs and strengthening collaboration with other companies. In the future, we will work on creating new business matching opportunities through public-private partnership initiatives.

Registration as “Numazu City SDGs Promotion Partner” of Numazu City, Shizuoka Prefecture

On December 12, 2023, Orico’s Numazu Branch was registered by Numazu City as a “Numazu City SDGs Promotion Partner”. This was the first case in which a branch of Orico was certified by a municipality. We will also promote SDGs initiatives at each business site in a locally rooted manner.

Registered as Tokyo Metropolitan Government's "Barrier-free Mindsets" Support Corporation

The Tokyo Metropolitan Government is promoting "Barrier-free Mindsets" to create a city where everyone can move around smoothly and enjoy various activities, not only by improving facilities, but also by thinking about a society and environment where all people can participate equally and continue to take necessary actions. In order to foster social momentum for "Barrier-free Mindsets", companies that work to raise awareness among their employees are registered as "Barrier-free Mindsets supporting companies", and our company was registered in FY2019.

We strive to be an attractive company where diverse talents can thrive. We promote inclusion and diversity by engaging in activities such as human rights awareness, employing people with disabilities, and providing career support for senior employees. Furthermore, we are committed to expanding various policies to ensure that all employees can balance their work with childcare, caregiving, and other responsibilities. As part of our community engagement efforts, we collaborate with organizations that support the employment of people with disabilities and organize internal sales events. By hosting these sales events, we strive to raise awareness of what these organizations do and promote community building with the local society.

- Tokyo Metropolitan Government Bureau of Social Welfare's Website

- Our "Barrier-free Mindsets" initiatives

- Inclusion & Diversity

- Initiatives to promote diversity

- Activities that support employment of individuals with disabilities

- International cooperation activities

Contributions to Local Communities

As part of our commitment to social responsibility, we are actively involved in various initiatives to strengthen our relationships with local communities.

Activities Promoting Employment for Individuals with Disabilities

At our head office and its annex, we regularly conduct in-house sales events in partnership with organizations dedicated to supporting employment for individuals with disabilities. We facilitate the sale of products to our employees and local residents, aiming to raise awareness about our partnering organizations' activities while fostering community engagement within the local society. Since October 2020, we have been introducing these organizations' online shops to our employees and hosting sales events. We remain committed to undertaking initiatives that further support employment opportunities for individuals with disabilities.

Support for the Next Generation

As efforts toward development of the next generation, we are taking initiatives through financial education, culture and art.

Financial Education and Industry-Academia Collaboration

In initiatives on financial education and industry-academia collaboration, we are taking finance-related various education and awareness activities in collaboration with parties such as municipalities and various organizations. Specifically, we have contributed to enhancing financial literacy of customers through actions such as initiatives toward next-generation education, public lectures toward prevention of multiple debts, and disclosure of content for new adults on a website.

Promoting Education for the Next Generation through Tuition Support Plans

We are working to support higher education students through our school-based education loans (Tuition Support Plan) with the aim of realizing a society in which all people can play an active role and gender equality, which is one of the eight areas of the "Specific Measures to Achieve the SDGs* (SDGs Action Plan 2020)" set forth by the Japanese government as goals for achieving the SDGs.

*Sustainable Development Goals (SDGs) set by the Sustainable Development Goals (SDGs) Promotion Headquarters, which consists of all ministers of state.

Orient Corporation Social Bond

Social Bonds are bonds issued to raise funds to solve social issues in accordance with the definition of the Social Bond Principles* established by the International Capital Market Association (ICMA).

*Guidelines based on voluntary procedures that encourage transparency and information disclosure in the social bond market and promote the development of order.

1. Outline of Social Bonds

| Issuance Number (lower row is a nickname) | The 24th Unsecured Bonds (bonds for individual investors) Orico Tuition Fees Social Bonds |

25th Unsecured Bonds (Bonds for institutional investors) |

|---|---|---|

| Issue term | 5 years | 5 years |

| Issue Amount | 5.0 billion yen | 5.0 billion yen |

| Interest rate | 0.32% | 0.32% |

| Application period | July 13, 2020 - July 27, 2020 | 2020/7/10 |

| Payment date | 2020/7/28 | 2020/7/17 |

| Underwriters | Mizuho Securities, Nomura Securities, Daiwa Securities, SMBC Nikko Securities, Mitsubishi UFJ Morgan Stanley Securities | Mizuho Securities, Nomura Securities, Daiwa Securities |

| Rating obtained | A- Japan Credit Rating Agency, Ltd. BBB+ Rating and Investment Information, Inc. "Social 1"Japan Credit Rating Agency, Ltd. |

|

| Use of Funds | Refinancing of funds procured for the execution of affiliated education loans (tuition support plan) provided by the company | |

2.Reporting

Status of appropriation of procured funds

All of the funds raised through this Social Bond have been allocated to refinance the funds raised for the Tuition Support Plan (funds for redemption of commercial paper). (As of July 31, 2020)

(2020年7月31日時点)Tuition Support Plan extracted for social loan pool

- Number of cases: 14,084

- Loan amount by school type (percentage) Universities, junior colleges: 58%, vocational schools: 42

- Number of schools covered: 1,992 (as of July 31, 2020)

3. Third-party evaluation of eligibility

As a third-party evaluation of the eligibility of this Social Bond, we obtained a rating of "Social1", the highest rating in the "JCR Green Bond Evaluation", from Japan Credit Rating Agency, Ltd.

4. Investment Statement Concerning this Social Bond

-

List of Investors (in Japanese alphabetical order)

- Asset Management One Co., Ltd.

- Ueda Shinkin Bank

- The Sugamo Shinkin Bank

- Daido Fire & Marine Insurance Co., Ltd.

- Sumitomo Mitsui Trust Asset Management

- JA Mie Shinren

(as of July 17, 2020)

Employee Social Contribution Initiatives

Orico Group Social Contribution Fund

In April 2012, we established the "Orico Group Social Contribution Fund," a fundraising mechanism to encourage our employees' social contribution activities. Employees can contribute as little as 100 yen per share, with the company matching each donation by adding an extra 100 yen for each participating employee. The collected funds are then donated to welfare organizations and regions affected by large-scale disasters through the "Orico Group Social Contribution Fund."

Support for Employee Social Contribution Initiatives

Moreover, to commemorate our 60th anniversary, we initiated a social contribution program in 2014 that today continues to introduce volunteer activities to all employees. Named the "Orico One Step Program," the initiative aims to transform the consideration of social contributions into action meant to benefit the community. Employees can sign up for activities of their interest, such as environmental conservation or disability support, through a dedicated website that lists such opportunities. These activities provide a sense of satisfaction and create awareness about societal needs, fostering personal growth. We have also introduced a volunteer leave policy to support employees willing to engage in long-term volunteer activities.

Sustainability

-

Sustainability Management

- Sustainability Management

- In this page, we introduce our sustainability management, the sustainability basic policy, materiality and other information.

-

Value Creation Process

- Value Creation Process

- This page introduces our Value Creation Process.

-

ESG Information

- ESG Information

- This page is a directory of our Environmental, Social and Governance (ESG) information. This page provides intuitive navigation to the information you are looking for on our sustainability management initiatives.

-

Social contribution activities

- Social contribution activities

- Here, we introduce our approach to social contribution and the results of our activities.

-

ESG Data

- ESG Data

- This page provides a range of ESG data on our sustainability management performance.

-

External Recognition

- External Recognition

- This page presents an external evaluation on our sustainability management initiatives.