Corporate Information

Medium-term management plan

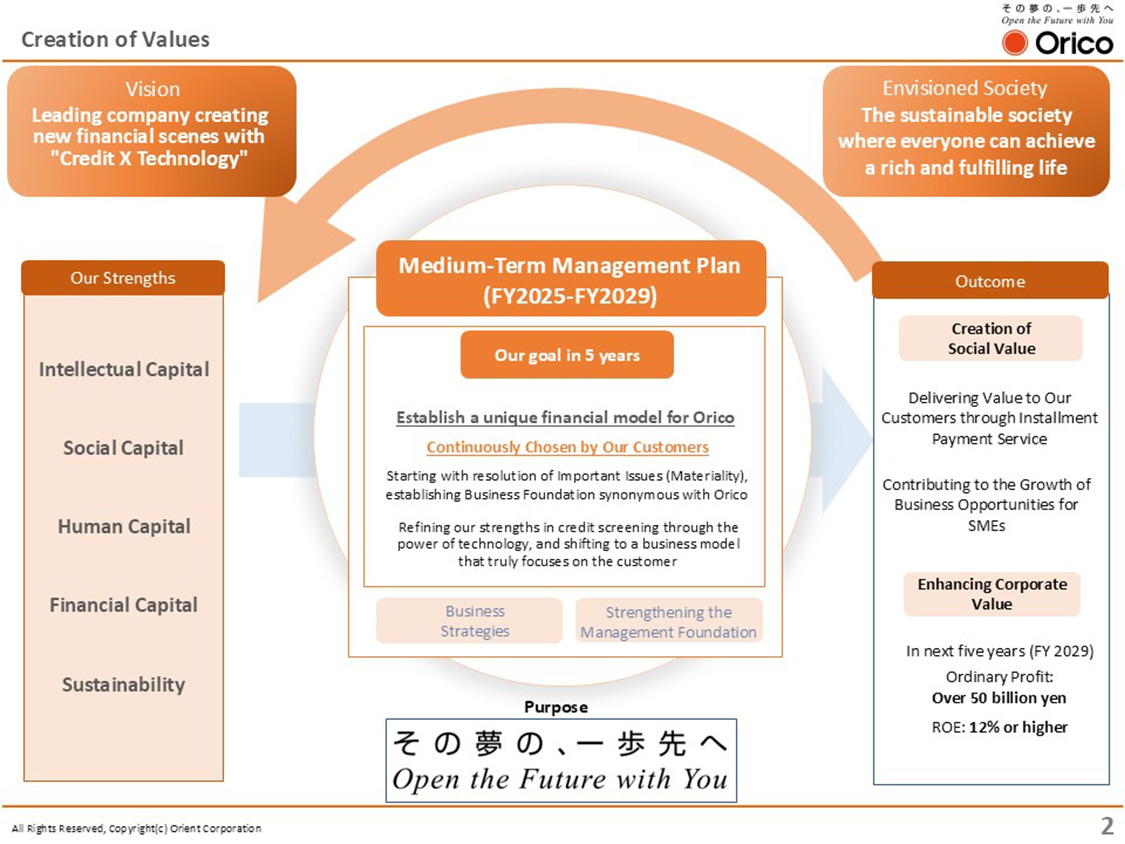

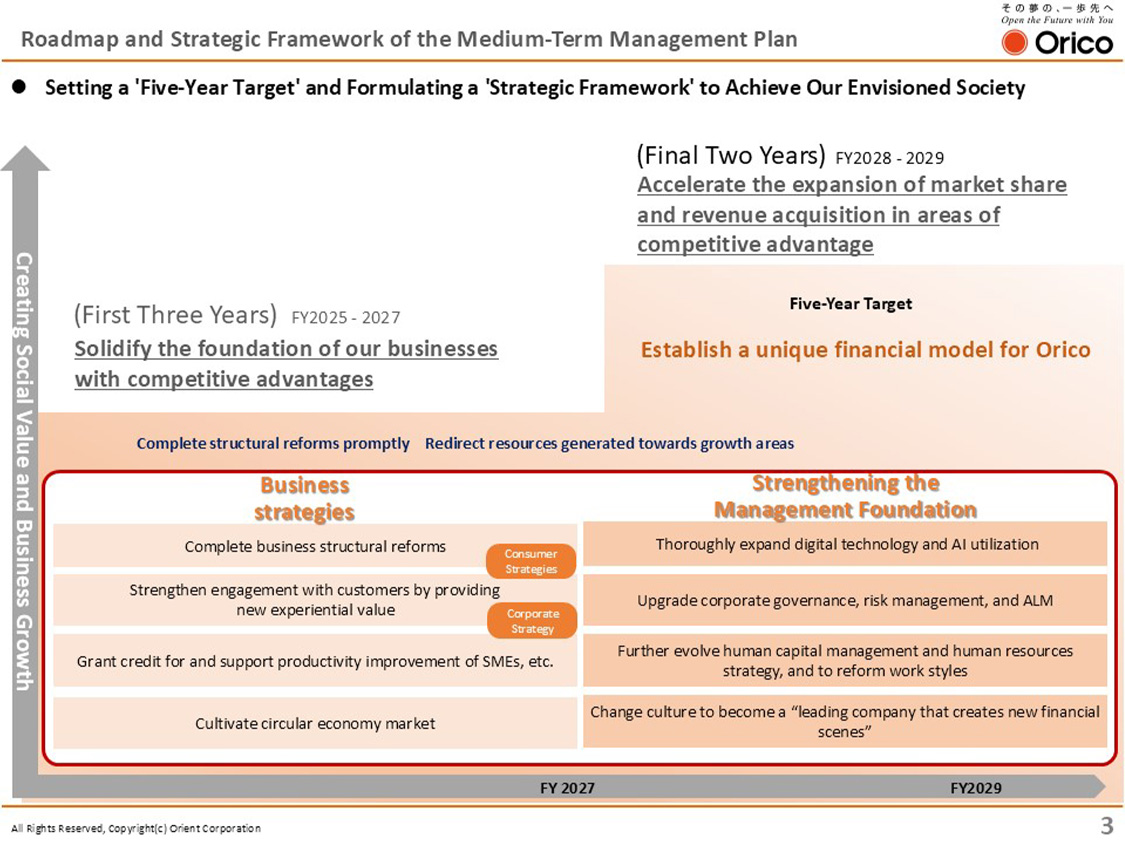

Based on our basic policy of solving social issues and enhancing corporate value, we have redefined our “vision for the society we aim to achieve in 10 years” and have set the final year of the new medium-term management plan as the year in which we will “establish a unique financial model for Orico.” This means “to establish a competitive business foundation that is synonymous with Orico, based on the resolution of materiality (high-priority issues)”. Orico will refine its strengths in credit screening, collections, and operations through the power of technology, and by shifting to a business model that truly focuses on the customer, Orico aims to become “an advanced company that creates new financial scenes through credit screening X technology”.

Corporate Information

-

Corporate information top page

- Corporate information top page

- Corporate information on Orient Corporation

-

President’s Message

- President’s Message

- President and Representative Director explains Orient Corporation’s management policy.

-

Corporate Philosophy

- Corporate Philosophy

- Orient Corporation’s Vision, Policy and Code of Conduct

-

Management Policies

- Management Policies

- This page provides an overview of our basic management policies

-

Corporate Governance/Risk Management/Compliance

- Corporate Governance/Risk Management/Compliance

- Introducing Orient Corporation's corporate governance/risk management/compliance.

-

Corporate Overview

- Corporate Overview

- Basic information regarding Orient Corporation, including its organization of head office, access information, management and history

-

Orico in Figures

- Orico in Figures

- Quantitative information on businesses of Orient Corporation

-

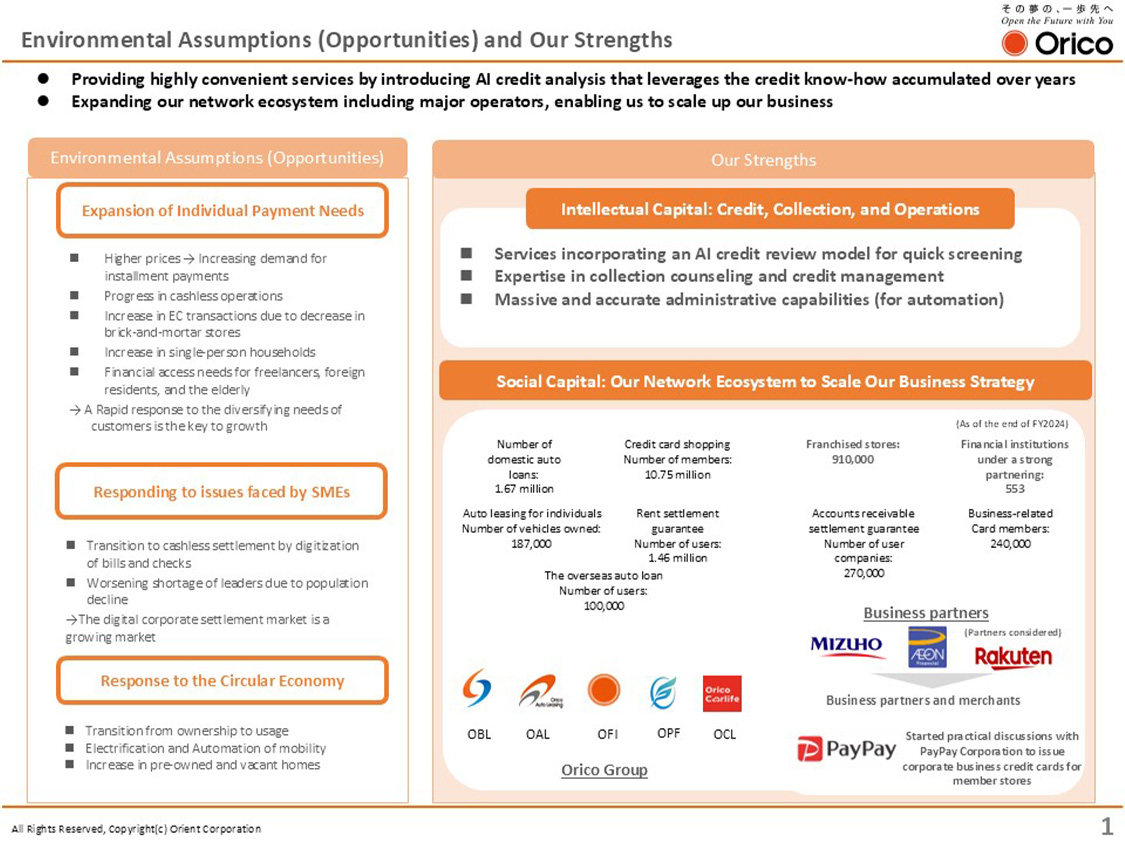

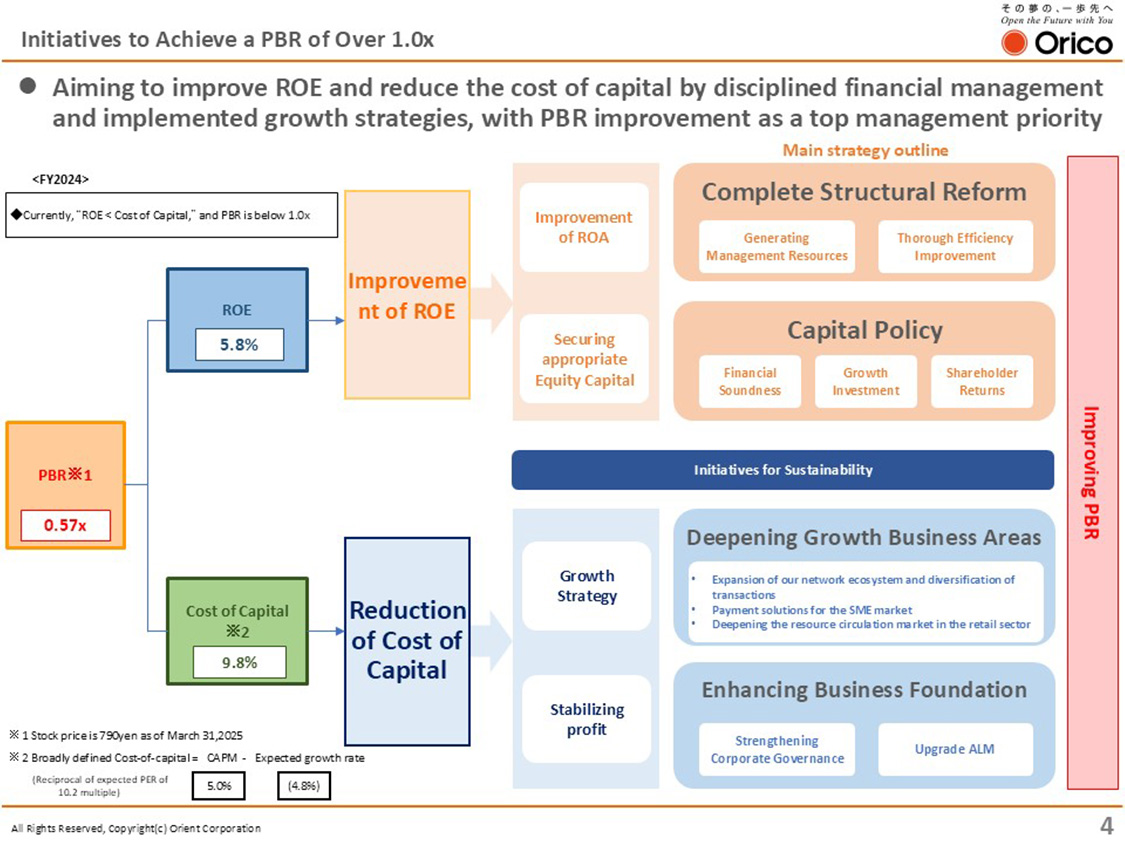

Growth Strategy

- Growth Strategy

- Orient Corporation's strategies and initiatives to contribute to society and enhance corporate value.

-

Business Overview

- Business Overview

- Orient Corporation’s operations including its auto loans, shopping credit, and credit cards business segments