Medium-Term Management Plan

Message from Head of Finance Group

Our Aspirations for the New Medium-Term Management Plan

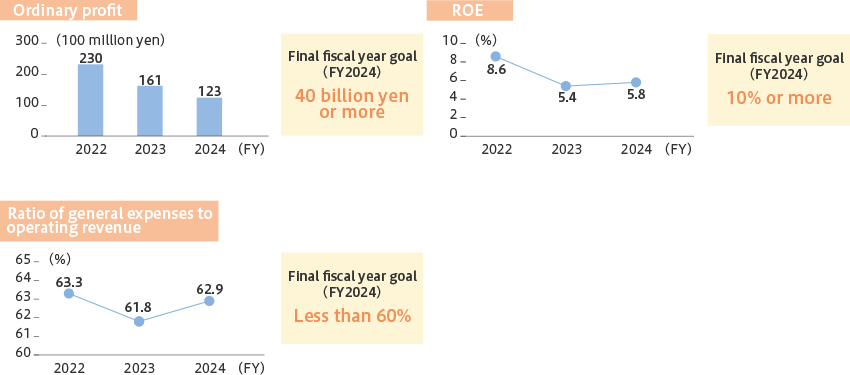

Regarding the previous Medium-Term Management plan, we fell short of all management targets: ordinary profit, ROE, or ratio of general expenses to operating revenue. External factors certainly played a role, including rising market interest rates since 2022 and the impact of the COVID-19 pandemic. However, it is undeniable that we were slow to implement fundamental measures to accelerate growth while adapting to these external changes.

For over ten years, we have had no choice but to invest a lot of managerial resources in resolving urgent issues, including responding to revisions to the Money Lending Business Act and Installment Sales Act, dealing with the problem of claims for refund of overpayment, replacing mission-critical systems, and redeeming preferred shares.

As stated in the opening top message, our efforts to sophisticate business portfolio management and ALM operations, as well as to strengthen investor relations, are still in progress and are still ongoing challenges.

Being the Head of Finance Group, I am keenly aware that my role involves leading the company's financial strategy to support sustainable growth while playing a crucial part in enhancing corporate value. I served as Head of Business Promotion Division until March 2025, earlier in my career having been responsible for finance, corporate planning, and overseas business. Leveraging my experiences, I am determined to bring about comprehensive reform across the entire company.

We will steadily execute strategies and measures to achieve the management objectives set forth in our new Medium-Term Management Plan. By practicing management conscious of stock price, we will take measures to restore a PBR above 1.0 x as quickly as possible. In terms of promoting strategies and measures under our new Medium-Term Management Plan, during the first three years, we will strive to promptly implement business structural reforms to establish a business foundation that offers us a competitive advantage, and, during the latter two years, we will take steps to accelerate the expansion of our market share and securing of revenue to achieve our management objectives as soon as possible.

Current Situation

Regarding the economic outlook, there are concerns that rising prices could dampen consumer sentiment and affect personal consumption. Furthermore, the impact of U.S. tariff hikes on the economies of various countries is a factor of anxiety, and the situation remains unclear. Close attention must be paid to fluctuations in financial markets both domestically and internationally.

Amid challenging business conditions, operating revenue increased in fiscal year 2024, the final year of the previous Medium-Term Management Plan . However, on a non-consolidated basis for Orico alone, revenue decreased by 4.2 billion yen compared to the same period last year. Major factors included the impact of three companies newly consolidated as subsidiaries: Orico Auto Leasing, Orico Business Leasing, and Orico Product Finance. Furthermore, operating expenses increased by 3.2 billion yen compared to the same period last year due to the impact of increased bad debt expenses in overseas businesses which was positioned as key markets. Additionally, amid the headwinds of declining profitability caused by delays in business structural reforms and rising interest rates, ordinary profit decreased by 7.5 billion yen compared to the same period last year.

Results of the Previous Medium-Term Management Plan

As mentioned above, in the previous mid-term management plan, the management targets such as ordinary profit, ROE, and the ratio of general expenses to operating revenue were all unachieved. We, as the management, take very seriously the fact that in the recent two fiscal years we were forced to revise down our performance projection. At the same time, there has been progress in financial discipline, with external credit ratings rising to A+, which we believe has contributed to the stabilization of our funding base. In addition, to meet the continued listing criteria of the TSE's Prime Market, we engaged in repeated dialogues with major shareholders and successfully achieved the tradable share ratio of 35% or higher, thereby satisfying all the continued listing criteria.

Financial Goals of Our New Medium-Term Management Plan

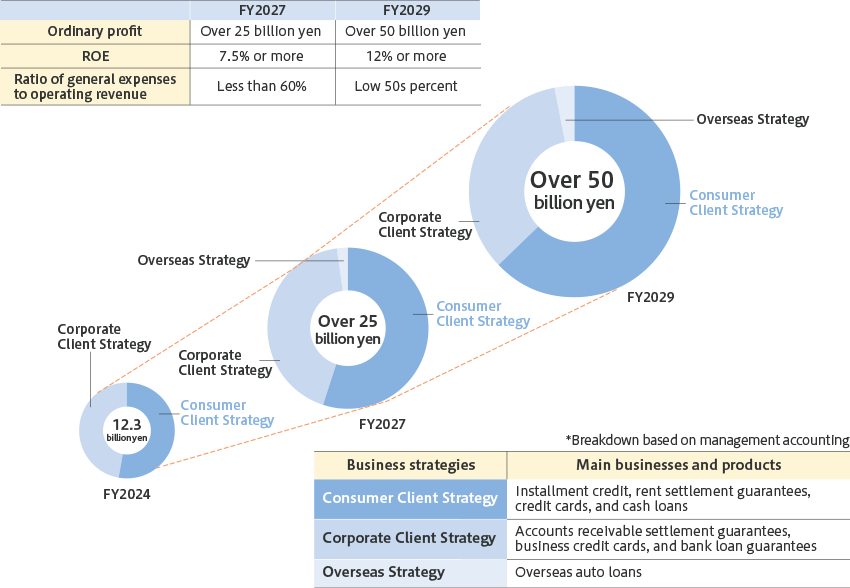

Under the new five-year Medium-Term Management Plan announced in May 2025, we have set management objectives for the final fiscal year, including ordinary profit over 50 billion yen, an ROE of at least 12%, and a ratio of general expenses to operating revenue of low 50s percent. The new plan, covering a five year period with an ordinary profit target set at over 50 billion yen, reflects our concern abuot the current situation where our PBR is below 1.0x.

However, based on our current situation, it appears that the market valuation does not reflect any level of confidence in our profit growth over the medium to long term.

The management objectives in our new Medium-Term Management Plan may appear somewhat ambitious; however if we steadily implement our business strategy, we expect to achieve ordinary profit of over 50 billion yen and to recover our PBR to above 1.0x.

Specifically, the installment credit business, which is the top priority in our business structure reforms, will be transformed into a leaner business model including Orico Product Finance. This will be achieved by shifting low-margin small-amount installment payments to digital installment payments, reviewing our sales structure, withdrawing from unprofitable clients, increasing administrative efficiency, and reducing expenses.

In addition, regarding our overseas business, we will reduce the scale of operations, pursue comprehensive cost-reduction measures for restructuring, and aim to establish a profitable business structure. Regarding our growth strategy, we will steadily implement our strategies in high-priority areas, including digital installment payments and auto leases (under Consumer Client Strategies), as well as business credit cards and accounts receivable settlement guarantees (under Corporate Client Strategies). Through these efforts, based on our operating revenue compared to FY2024, we aim to achieve an increase of over 75 billion yen under Consumer Client Strategies (including over 25 billion yen from digital installment payments and over 10 billion yen from the circular economy strategy), and an increase of over 20 billion yen under Corporate Client Strategies, in order to achieve an ordinary profit of over 50 billion yen, which is one of our management objectives.

Moreover, fiscal year 2025, as the first year of our medium-term management plan, is particularly important for reinforcing the foundation of the plan. Although our current plan is to achieve ordinary profit of 12 billion yen, which is lower than last year, we are pursuing initiatives such as expanding the number of member stores offering digital installment payments, improving convenience, and developing platforms for the corporate market.

While some results may take a little longer to materialize, we intend to make steady progress on our strategies this year, looking ahead to our five-year goals.

Management Objectives

Towards the Implemention of Management that is Conscious of Cost of Capital and Stock Price

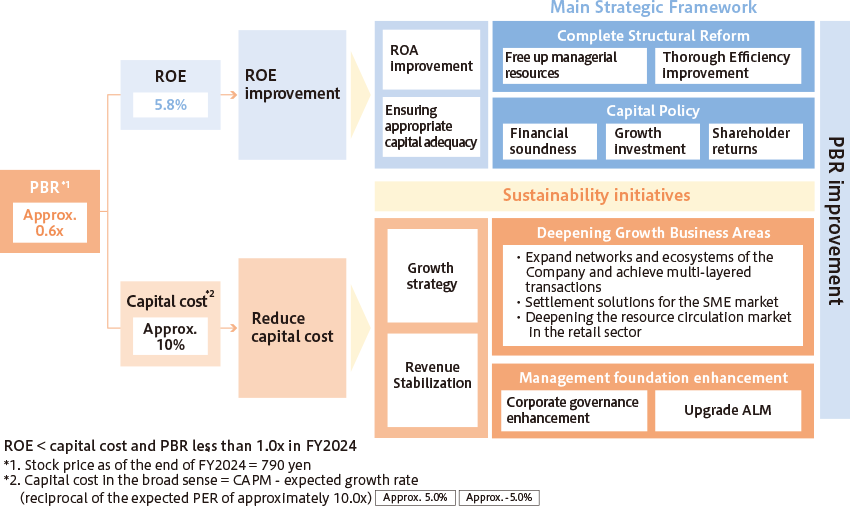

Our PBR has remained below 1.0x, and our TSR also falls below 100%. Given these market assessments of our company, we are gravely concerned and have positioned the early recovery of PBR above 1.0x as our most critical management priority. The persistent PBR of less than 1.0x stems not only from our failure to meet targets but also, we believe, from a lack of dialogue with capital markets.

In light of these challenges, our new Medium-Term Management Plan outlines business strategies and a profitability roadmap aimed at restoring our PBR above 1.0x. To this end, we will pursue improvements from both the perspectives of improving ROE and reducing the cost of capital.

First, to improve ROE, we recognize that improving ROA and securing an appropriate level of equity capital are essential.

As a consumer credit company, building up a certain level of assets is unavoidable, making the improvement of ROA paramount. The key lies not merely in pursuing profits, but in how efficiently we manage our operations.

As described above, in order to increase the efficiency of our assets, we must implement business structural reforms in order to achieve a profitable structure. Specifically, we must actively invest the managerial resources freed up by the reforms in each strategy specified under our new Medium-Term Management Plan, replace our business portfolio, strive to redistribute resources and expand our profits in markets where we have a competitive advantage. Regarding optimal capital adequacy, we will aim for capital management that balances investment for sustainable growth with shareholder returns, while maintaining financial soundness by considering the balance between equity and debt on the premise of securing stable funding.

Moving on to reducing capital costs, we intend to enhance expectations for our business as we execute our growth strategy, while also enhancing our management foundation and stabilizing earnings.

Currently, through partnerships with Mizuho Bank and AEON Financial Services, our network ecosystems are steadily expanding. As our customer base grows, we will enhance customer engagement for our Consumer Client Strategies by providing new experiential value from the customer's perspective and achieving multi-layered transactions. Furthermore, through the full-scale rollout of the digital installment payment app Waketara (called Waketara below), we will enhance customer loyalty and engagement, aiming to become a company of choice while also pursuing revenue growth. To cultivate the circular economy market, we will focus on leveraging our strengths in terms of auto leases for individuals to seize the shift from ownership to use as we explore the resource recycling market in the retail area. Our Corporate Client Strategies are to respond to the settlement needs of our member merchants, our business partners, and increase the sophistication of our corporate credit extension model to establish superiority in the accounts receivable settlement guarantee market and business credit card market, both of which are growth markets.

To build a strong management foundation, it is important not only to strengthen corporate governance but also to comprehensively manage assets and liabilities and to upgrade ALM to suitably control risk. For a long time, we enjoyed the benefits of a “world without interest rates” . However, we have now entered a “world with interest rates” and, furthermore, a “world of fluctuating interest rates” . Market interest rate trends have become a significant variable that greatly impacts business management. We will continue striving to upgrade ALM as part of our efforts to restore our PBR to a value over 1.0x.

Initiatives to Achieve a PBR of Over 1.0x

Due to the nature of the non-bank business model, our balance sheet possesses a unique risk profile distinct from regulated financial institutions such as banks. Quantifying interest rate risk and liquidity risk based on the characteristics of our specific assets and liabilities is therefore critical. By visualizing the impact these risks have on management, we aim to achieve optimal ALM operations that contribute to management stability. By making operations flexible and sophisticated-through hedging individual funding rates and implementing dynamic balance sheet hedging-we seek to capture the interest margin, or ALM revenue, arising from the duration mismatch between assets and liabilities.

Such initiatives aimed at restoring our PBR to a value greater than 1.0x are not only for improving our short-term financial indicators, but also for improving our sustainable corporate value in the medium to long term. These initiatives will be achieved through the understanding and action of each member of our management team and our employees. We will also advance efforts to ensure that the significance of these approaches permeates not only management but every single employee.

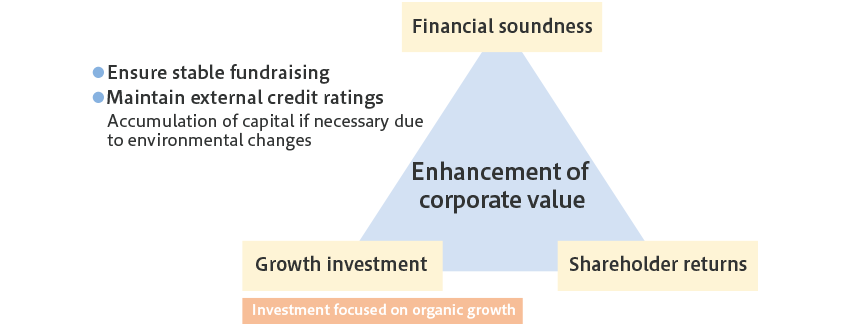

Capital Policy

Under our new Medium-Term Management Plan, our capital policy calls for the realization of an optimal balance between financial soundness, growth investment, and shareholder returns, and, in terms of shareholder returns, we assume the provision of dividends and have clearly stated our intention to provide progressive dividends.

Financial soundness

For non-banks, ensuring fundraising stability and reducing the cost of fundraising are extremely important, therefore maintaining or improving our credit rating is an important element of our financial policy. We conduct financial operations with the premise of maintaining and improving our credit rating. As a result of risk hedging centered on asset financing, which is fixed-rate funding, the fixed funding ratio has hovered around 75%, and the direct funding ratio has also remained at 64%.

The capital adequacy ratio stands at 8.3%, slightly above 8.0%. While we recognize the level as resilient to changes in the external environment, we anticipate the equity ratio could potentially decline by approximately 0.5 to 1% under certain stress scenarios. Considering this point, we also recognize the need for a certain level of capital accumulation.

Growth investment

In our new Medium-Term Management Plan, we will focus on capital efficiency, concentrating investments in strategic areas with high growth potential and prioritizing organic growth. Specifically, to improve ROE and market growth rates, we will allocate resources to each strategic pillar of the new plan: card services (digital installment payments), accounts receivable settlement guarantees, and auto leasing. We will also allocate resources to IT and human capital strategies to strengthen our foundation for improving profitability, including enhancing competitiveness, improving operational efficiency, and creating new business value.

We will carefully select and time our decisions regarding inorganic growth investments. We will consider capital utilization and strategic investments with appropriate discipline, aiming to build an optimal business portfolio and work toward sustainable growth and enhanced corporate value.

Shareholder returns

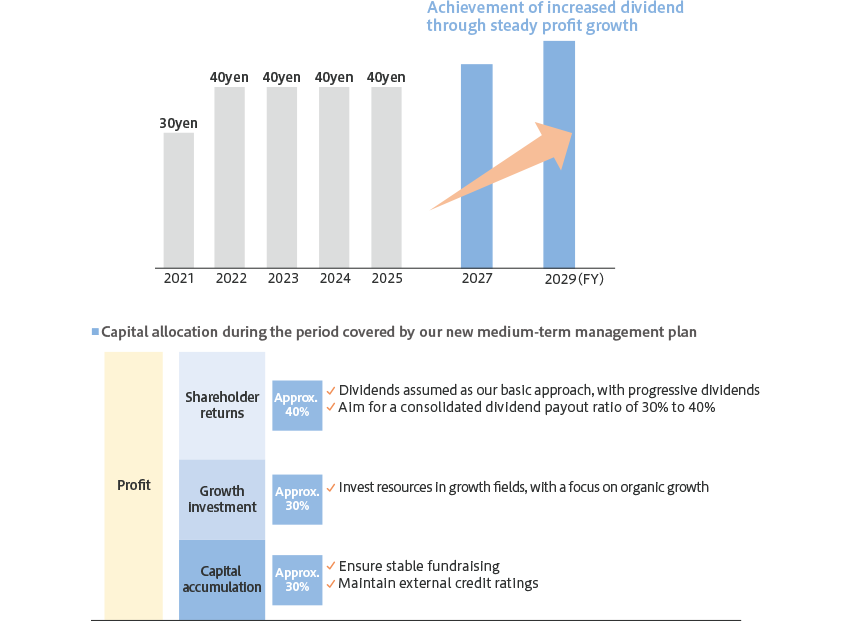

To handle shareholder returns during the period covered by our new Medium-Term Management Plan, instead of stock repurchasing, we will prioritize dividend-based returns.

We have decided on a dividend policy that is based on progressive dividends, and we will aim for a consolidated dividend payout ratio of 30% to 40%.

Up until now, in addition to improving our corporate value, we have positioned the appropriate return of profits to our shareholders as one of our key management priorities. Ever since we resumed the provision of dividends in fiscal year 2016, we have not reduced dividends and have strived to provide consistent and ongoing dividends.

We have introduced progressive dividends in an effort to further clarify our intention to return profit to shareholders who hold shares of the Company over the long term and to make clear our intention to increase dividends by achieving steady profit growth.

In terms of dividend payout ratio, because we plan to pursue balanced capital management in accordance with the situation, we have left ourselves some leeway and intend to handle this flexibly.

We have disclosed a dividend forecast of 40 yen for fiscal year 2025, which remains unchanged. However, we will pursue steady profit growth while executing the strategies outlined in our new Medium-Term Management Plan, aiming to increase dividends during the plan period.

To Our Valued Stakeholders

Under our previous Medium-Term Management Plan, we initiated business portfolio management. With progress in visualization, including analysis and evaluation based on risk and cost returns, we have raised awareness of business portfolio management. Throughout the formulation stage of the new Medium-Term Management Plan, we have repeatedly discussed the medium-to-long-term direction of each business portfolio while setting a common ROE target. We will further advance the refinement of our business portfolio management to achieve an early recovery exceeding PBR of 1.0x.

Recently, we have been receiving an increasing number of requests from investors for more in-depth questions about individual businesses and for enhanced information disclosure. I believe that one important mission of the Head of the Finance Group is to engage in constructive dialogues with investors and other stakeholders, and it also seems important to accurately explain our strategies and the nature of our business to ensure that they are well-understood.

We will naturally continue to disclose accurate information on our performance and strategy in a timely manner, but we will also consider opportunities for investors to engage in dialogues with not only Mr. Umemiya, our President, but also our Outside Directors. Management will work together to build open relationships with every stakeholder.

We intend to share the insights, learnings, and opinions gained through dialogue with all of you with the Board of Directors and management, and use them as reference for business operations, capital policies, and other matters. We will also make every effort to provide sufficient information so that our investors can gain a deeper understanding of our Company. We will be particularly mindful of proactively disclosing information on areas of high interest and, and will continue to engage in two-way engagement, which will lead to sustainable growth and increased corporate value.

Additionally, to clarify our target groups beyond previous product-specific disclosures, we are now disclosing results categorized by Consumer and Corporate Client Strategies. We are still in the process of trial and error, but we will strive to create IR materials that are easier for our stakeholders to understand.

We would like to ask for the continued understanding and support of our stakeholders.