Message from the President

Management Challenges and Their Root Causes

My name is Makoto Umemiya. I was appointed President and Representative Director of Orico in April of this year. Before this appointment, I spent the majority of my 37-year career at the Mizuho Financial Group in finance and planning. I served as Chief Financial Officer from 2017 to 2023, after which I took on the role of Chief Digital Officer. In April 2024, I finally joined Orico as its Executive Vice-President. At the time, I wondered whether I was really suitable for the job because I didn't know much about the retail business, including credit sales and credit cards.

Upon joining Orico, I had the impression that we have a solid business foundation and a deliberate growth strategy that leverages the strengths of our foundation.

Specifically, we have a network of installment-credit member merchants cultivated over our 70-year history, an extensive customer base of credit card users, outstanding assessment abilities core to our retail lending business, large-volume administrative processing accuracy, strong debt collection counseling and negotiation skills tailored to each individual, and earned credibility and trust with our customers, both individual and corporate, thanks to our safe, secure, and convenient settlement methods-all underpinned by our product development abilities. Although I cannot give each of these strengths the attention it deserves in such a short space, Orico has many strengths of which we should be proud. I had the impression that Orico has the potential to transform the financial scene of the retail sector.

Looking at our growth strategy, it was extremely reassuring to see that we are placing sustainability at the core of our management, and are making progress in several areas on initiatives aimed at creating business that starts with the resolution of issues faced by both customers and society. Major examples include Waketara, a digital installment payment app we released in February 2025; Akikatsu Loans, which are helping to resolve the problem of vacant houses; and our multiple alliance-based strategies that aim to scale up such initiatives. The prospects for our future growth seemed very exciting.

On the other hand, looking at the performance side, our profit levels have been steadily declining, consistently failing to meet publicly announced management targets, and our stock price has long traded at a PBR significantly below 1.0x for years. Given Orico's strengths and the growth strategy we have steadily implemented, failing to reach an ordinary profit of just 20 billion yen is hard to accept. We cannot be satisfied with the current state of outcomes.

Across the duties I have been involved in as supervisor of both the Corporate Strategy Group and the Finance Group and as Executive Vice-President, including the structural reform of our installment credit business and the formulation of our new Medium-Term Management Plan, I have become acutely aware of two major challenges.

The first issue is that the Group lacks sufficient organizational capabilities necessary to formulate and execute our financial strategy. Here are some specific examples. Several years ago, we initiated our efforts to evaluate each business using a two-axis framework of risk-return and cost-return, aiming to drive transformation of our business portfolio. However, discussions primarily focused on how to increase returns, leaving the optimal allocation of resources based on profitability and future potential relative to management resources, as well as the restructuring of the business portfolio, only halfway completed.

Furthermore, although the underlying management accounting system was established and introduced several years ago, subsequent reviews and enhancements have not been sufficiently implemented. As we returned to a world with positive interest rates, increasing the sophistication of our ALM*1 operations should have been one of our top management priorities. In reality, however, we only introduced certain hedging methods and adopted simple measures such as estimating maturity gap*2 and calculating VaR*3. No comprehensive framework was established to effectively utilize these measures for controlling interest rate risk on both assets and liabilities. Despite persistently low stock prices and a prolonged period below a PBR of 1.0 x - a situation in which the company is labelled a failed listed entity - its efforts in investor relations towards equity investors were wholly inadequate. It must be said that the organisation lacked the CFO-type expertise and capabilities that should have been in place.

The second challenge is about our corporate culture. Within each department, there is a strong sense of fellowship, cooperation, and teamwork-a wonderful organizational climate that we wish to continue cherishing. However, when viewed across the entire organization, a serious issue has emerged: increasing "silo mentality" stemming from reluctance to engage with other departments and a lack of interest in them.

Furthermore, a significant challenge is the overall tendency to take the easy way out. Even when fundamental discussions about sustainability, reevaluating our Corporate Philosophy, and Inclusion & Diversity*4 take place at the management level, the essence often gets sidelined during implementation, with the goal becoming merely ticking boxes. There were numerous instances where people hesitated to tackle challenging initiatives, or decided their own limits by saying, "This is sufficient for us as we are now" and stopped there.

To put it bluntly, the entire organization has fallen into a state of mutual indulgence with complacency. Of course, we have taken various management measures to resolve these challenges related to our corporate culture, including reviewing our Corporate Philosophy, establishing a new Purpose and Value, and focusing on engagement and practice initiatives within the organization. Unfortunately, these efforts have not led to satisfactory results.

As I became increasingly aware of these challenges, I finally overcame my initial doubts regarding whether I am truly qualified to effectively rebuild the Company. What the organization really needs right now is the establishment of effective CFO functions as part of our management and a major transformation of our corporate culture. As the CFO of the Mizuho Financial Group, I promoted fundamental structural reforms. In addition, I was a member of the management team that transformed Mizuho's corporate culture, which was the cause of their system failures in 2021. Now, what Orico needs is for me to leverage this experience to the fullest extent.

*1 Asset liability management: the practice of comprehensively managing both assets and liabilities in a unified manner

*2 The difference between the maturity amounts of assets (e.g., loan collections) and liabilities (e.g., FILP bond redemptions) during each period

*3 Value at risk: an estimation of the maximum loss (that is acceptable for management)

*4 We believe that diversity truly demonstrates its value only when inclusion is achieved-that is, when diverse talent within our organization can express their individuality, generate innovation through free thinking, and enhance the Company's competitiveness.

Medium-Term Management Plan

From this point onward, I would like to discuss the new Medium-Term Management Plan that I myself have led in formulating as Executive Vice-President, based on our Group's strengths, challenges, and environmental awareness. Let me share the vision behind the plan and the strategic direction we are pursuing.

First, in terms of our financial goals under our new plan, we aim to achieve an ordinary profit of over 50 billion yen during the final fiscal year of the plan, fiscal year 2029, which is four times that of fiscal year 2024, as well as an ROE of at least 12%. This level of financial goal represents the benchmark required to recover above a PBR of 1.0 x, and we developed detailed strategies to achieve it through backcasting. As mentioned earlier, a PBR below 1.0 x signifies the market labelled the Company as a failed listed entity. It is no exaggeration to say that the new Medium-Term Management Plan was formulated specifically to achieve a PBR exceeding 1.0 x. Naturally, merely setting ambitious targets does not guarantee plan achievement. Without concrete quantitative plans backed by solid strategy, it becomes mere number-juggling.

Our "Growth Strategy" leverages our strengths to establish competitive advantage. Our "Business Structural Reform" transforms how we operate and the company itself without sacred cows, enhancing profitability relative to finite management resources while responding swiftly to environmental changes. At the same time, our "Management Foundation Strengthening" supports these initiatives. These three components comprise our new Medium-Term Management Plan.

At the beginning of formulation phase, following the pattern of previous medium-term management plans, we thoroughly discussed whether the aforementioned financial targets could be achieved within three years, as well as the pace and depth of initiatives related to growth strategies and business structural reforms. Unfortunately, three years were not enough time to paint a complete picture, so we extended the period to five years. During the first three years, we will lay the groundwork for growth. Then, over the next two years, we will reap the rewards of our efforts. We will strive to achieve this ahead of schedule.

| Differences with our Previous Medium-Term Management Plan | |

|---|---|

| Period of five years | During the first three years, we will strive to promptly implement business structural reforms to free up managerial resources, allocate them to growth areas, and establish a business foundation that offers us a competitive advantage.During the latter two years, we accelerate the expansion of our market share and securing of revenue to achieve our management targets. |

| Management conscious of stock price | The plan clarifies our path and policies for an early recovery exceeding PBR of 1.0x. |

| Shifting to a business model that truly focuses on the customer | We described policies for engaging with both individual and corporate customers in terms of enhancing customer engagement in line with its business strategy, extending credit to SMEs, and providing support to increase their productivity. |

| Corporate Cultural Reform | The addition of corporate culture reform—which is a fundamental element underlying our various challenges—as a key priority for strengthening our management foundation. |

Growth Strategy Rooted in Solving Social Issues

Japanese society stands at a crossroads, facing accelerating trends in its aging and shrinking population, increasingly diverse individual lifestyles and values, work-style changes stemming from technological progress, backlashes against globalism, rising nationalism, increasingly intense natural disasters due to global warming, and upheavals that were inconceivable in the not-so-distant past.

Many of these trends will have major effects on the Company's business areas. We must be prepared to respond, including reassessing our business operations. As we progress toward a cashless society, financial crimes and fraudulent practices are also becoming increasingly sophisticated, so ongoing initiatives to ensure both convenience and safety for our customers are vital.

SMEs face increasingly severe talent shortages, and finding ways to improve productivity has become a matter critical to their survival. One way approach that is being increasingly considered is the use of foreign national workers, but there is not enough support available for them to start a new life in Japan, financially or otherwise. The way things are going, foreign nationals may no longer consider Japan an attractive option.

Another issue is the abolishment of paper-based promissory notes and checks at the end of fiscal year 2026. There is an urgent need to promote the spread of alternative methods for SME corporate settlement in particular. There is a mountain of other challenges to be met, including regional issues and environmental problems.

In our previous Medium-Term Management Plan, we placed sustainability at the core of our management for the first time and formulated a growth strategy centered on solving social issues. Although I believe it was a fairly progressive initiative, unfortunately, it did not articulate at a sufficient level how we could leverage our strengths to contribute to solving specific challenges for whom. Consequently, the connection to our strategy became rather vague.

In our new Medium-Term Management Plan, we have reflected on past lessons. We began discussions by re-evaluating our strengths realistically and re-identifying the materiality-the key issues requiring priority attention-before outlining our growth strategy.

Our Strengths and Competitive Advantage

Our Group has over 10 million credit card members, and we have handled approximately 1.7 million auto loans and 1.4 million rent settlement guarantees. We also have around 900,000 member merchants throughout Japan and over 550 affiliated financial institutions, all of which make up our ecosystem. In addition, we engage in partnerships and alliances with major business operators that have their own ecosystems, such as AEON Financial Service, the Rakuten Group, and Amazon, in addition to Mizuho Bank, a major shareholder. These customer bases and business foundations are strengths we take pride in, but the true strength behind building such foundations lies in the power of "credit extension" we have cultivated over our 70-year history.

Here, "credit extension" encompass the entire process from start to finish-including credit assessment, fund settlement, fund collection, and all related administrative procedures-with distinct strengths for both individual and corporate clients.

First, let me explain the strengths of our credit extension capabilities for individual consumers.

Our Group possesses a vast storage of customer credit data collected over many years, and we continue to add up new data through thousands of daily transactions. The existence of this wealth of data related to long-term installment payment credit is the source of our Group's competitiveness. Many business operators have entered the individual financial business, but our Group possesses an unmatched wealth of data. By fully leveraging data through cutting-edge technologies such as AI, we will deliver products and services that are unmatched by competitors.

Here, I would like to present two examples.

The first is our certification as a Certified Comprehensive Credit Purchase Intermediary. We are the only major credit card company or installment credit business operator to obtain this certification. We utilize AI-powered credit functions to develop products and services that provide new value for customers in the form of "digital installment payments".

"Digital installment payments" are a completely new financial service, allowing customers to make installment payments within their available credit limit instantly, at any time, and as often as they want. This frees both customers and member merchants from the hassle of applying and undergoing an assessment.

Major EC sites and appliance retailers have already started using this service, and we plan to dramatically expand locations where it can be used. This is a groundbreaking service that can meet our customers' diverse installment payment needs, and we aim to develop it into one of the pillars of our growth strategy under the new Medium-Term Management Plan.

The second example is our introduction of risk-based pricing, which allows us to set extremely detailed conditions according to the creditworthiness of individual customers. When it comes to individual credit, unlike in the case of corporations, it is not typical for the creditworthiness of each person to apply to the corresponding interest rate.

Meanwhile, looking globally, in the the U.S., FICO scores are used in various situations where creditworthiness is emphasized, including loan interest rates, serving as a form of social infrastructure. In Japan, CIC, the Designated Credit Information Organization, started disclosing credit guidance similar to the US, so the rest of the world seems likely to start employing different borrowing interest rates and other economic conditions according to the creditworthiness of individuals.

Our Group has already developed a model to measure risk-based pricing, which applies interest rates based on individual creditworthiness and risk. We began a Proof of Concept (PoC) in fiscal year 2025 to verify its effectiveness and customer acceptance. For this initiative to gain widespread adoption, the economic terms our Group presents must be sufficiently transparent and agreeable to customers.

Leveraging our distinctive capabilities-highly accurate credit models based on our vast amount of accumulated credit data, our low-cost operations made possible by utilizing digital technology and AI, and our strong execution capabilities in credit collection operations which demand a high level of expertise-we will continue to take on initiatives that our Group is uniquely positioned to handle.

Next, I would like to briefly touch upon our Group's strengths in credit extensions for corporate clients. Beyond our performance and accumulated data related to credit for individual business owners and corporate representatives, which is a natural extension of individual credit, our experience managing the credit of approximately 900,000 member merchants in the installment credit business serves as one of our biggest strengths for our Group to compete in the corporate sector.

In particular, our business card-a flagship product for SME credit-is highly regarded even by major corporations with their own ecosystems, paving the way for scaling.

We are also collaborating with advanced fintech companies to develop "a cash flow prediction model" and "an optimized fundraising plan presentation model" based on cash-on-hand movement, invoice, and payment information. By providing these models on smartphones as the ultimate cash flow app, we hope to free SME owners from their day-to-day cash flow struggles.

Mega banks and various other financial business operators are currently accelerating their initiatives in this market, but we are confident that our Group is one step ahead. We aim to cultivate the solution as the second pillar of our Group's growth strategy while providing a certain solution to the social issue of labor shortages in SMEs.

Business Structural Reforms

To advance the growth strategy discussed thus far, we must establish a robust CFO function while redirecting necessary managerial resources from the shrinking areas to the growth areas. We began by evaluating each of our businesses based on the shared perspectives of risk and cost returns to visualize challenges associated with our risks (capital), costs (expenses), and returns (revenue). Next, we considered the upcoming business environment to formulate plans specific to each business. Based on this analysis, there were some businesses for which we could not envision a path for achieving an ROE over 10% during the period covered by our new Medium-Term Management Plan. In these cases, we conducted repeated discussions, including the re-examination of our overall approach to such businesses, to shape the final plan.

For example, we predicted that our Group's installment credit business would suffer from worsening risk and cost returns due to challenges that included the maturity of the market and rising interest rates. Under conditions where a significant improvement in returns is difficult, the necessary measures to achieve a business ROE exceeding 10% boil down to how lean we can make our cost structure.

We withdrew from unprofitable business, reviewed our branch network, consolidated stores as necessary, and took advantage of digitization to increase the efficiency of our administrative and collection work to greatly reduce our required personnel and other managerial resources, thereby achieving the ROE hurdle rate. In particular, our administrative costs associated with low-price shopping credit were high, while cost returns remained at an extremely low level, so we boldly shifted our managerial resources to digital installment payments and took other steps to strike a balance with our growth strategy.

We held similar discussions for each of our businesses, ultimately finding a way to strike a balance between stability and growth potential for our business portfolios. This is the basic concept behind the business structural reforms called for by our new Medium-Term Management Plan. However, given the extreme uncertainty of our future business environment, we cannot allow ourselves to become too committed to a set plan. Instead, we must dynamically respond to changing circumstances.

We will continuously review our operations, including challenging new growth areas and delving deeper into shrinking areas to free up management resources for these endeavors.

Strengthening the Management Foundation: Corporate Cultural Reform

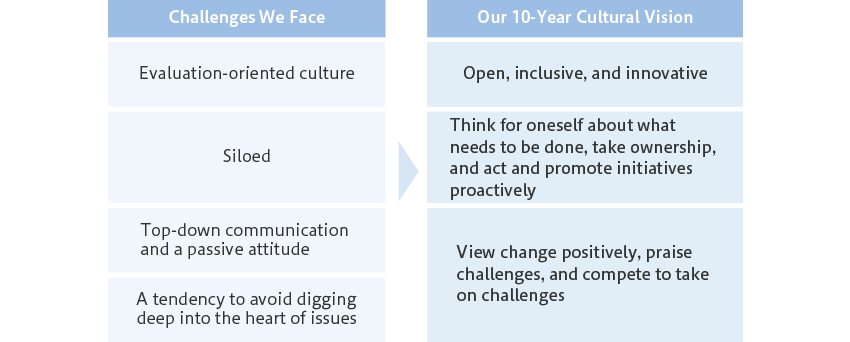

Though I already mentioned the challenges in our corporate culture, even if we come up with a clear vision and concrete business strategy, it is our people who actually execute it. To achieve our goals, it is essential that we foster a culture that encourages employees to enjoy challenges, where they can work vibrantly and collaborate with their colleagues. "Open, inclusive, and innovative" "Think for oneself about what needs to be done, take ownership, and act and promote initiatives proactively" "View change positively, praise challenges, and compete to take on challenges"-We share these three pillars as our cultural vision with employees. To realize them, we believe it is crucial not only to encourage employees through tangible arrangements such as improving the work environment and revising personnel and evaluation systems, but also to appeal to the soft aspects-the mindset and behavior patterns of each individual employee-to drive change.

I am well aware that doing so requires significant time and effort. Some of our employees will likely find themselves unenthusiastic or unconvinced, but corporate culture reform is the most important theme of our new Medium-Term Management Plan, so we will do everything in our power to achieve it.

Details of the corporate cultural reform will be covered on pages 43-45. Regarding responses at the institutional level, we will focus our efforts on promoting "BPX - Business Process Transformation" and "DX" to fundamentally review business processes and build an environment where each employee can enhance productivity and engage in work creatively.

Regarding DX in particular, based on the Orico DX Vision, which we formulated in April 2022, we established a Company-wide DX promotion structure to focus on training digitally skilled personnel. With our basic program, we successfully trained 3,000 employees two years ahead of schedule, and we established a foundation for utilizing AI to transform our business processes and to create new business models.

Going forward, we will thoroughly promote the utilization and application of data and AI to transform all of our business processes, including sales, marketing, administration, accounting, system development, and risk management. In addition to these initiatives, we will review any other system that could affect our corporate culture, including our evaluation and authority systems, and consider our future approaches accordingly.

From a psychological standpoint, we will focus our efforts on "Organizational Development" and "Brand Strategy" as well as the launched last year" Corporate Philosophy Empathy and Practice Activities". Here, I would like to briefly touch on the newly initiated Organizational Development.

The goal of organizational development is to build an "'inclusive' organization where colleagues face each other and mutually empower one another". To achieve this, we intend to identify communication challenges between managers and subordinates, between individuals and the organization, and between different organizational units, providing optimal interventions tailored to the specific challenges at respective working sites. Creating an environment where psychological safety is secured and individuals can freely express their opinions is only the starting point. We aspire to achieve true inclusion-where one's opinions and feelings are accepted by others, and where those around them actively support and encourage those sentiments.

Our Commitment to Reform

No matter how we explain our Group's strengths, value creation story, or new Medium-Term Management Plan, our repeated failures to meet past targets represent a serious barrier to winning everyone's trust. Our only option is to rigorously execute each of our strategies and deliver results so that we can begin to earn trust.

Our Group's Purpose, "Open the Future with You", expresses our determination to take genuine care of each of our customers and leading with enthusiasm, staying close to the present and the future status of each of our individual customers, living people, and our corporate clients, including SMEs and individual business owners, while also leveraging our Group's credit capabilities to such valued customers.

When our Group was founded in Hiroshima 70 years ago, we developed and provided products and services as only we could for customers who tended to get left behind by the financial markets of the time. Today, pioneering DNA still lives within us.

Upon my appointment as President, we decided to entrust the creation of branch management plans to our General Managers throughout Japan. We have told our General Managers to try to be enthusiastic concerning what kind of branch they want to be in the medium to long term based on careful consideration of factors relevant to branch management. These include the regional characteristics and business environment of the branches they have been entrusted with, their profit and trading structures, and issues related to human resources and organizational operations.

For many employees who had previously believed that the role of General Managers at branch was to achieve targets assigned by management or Head Office to each branch, the initial period was apparently filled with nothing but confusion. However, I am currently visiting our branches to hold dialogues with General Managers and employees about their daily struggles and management-related opinions and needs, and I'm starting to see signs of change.

Dialogue with employees

I have even seen General Managers working with other companies, local governments, among other stakeholders, to revitalize local economies by considering what they can do and incorporating the findings into their plans. It has been quite reassuring for me to see our General Managers fighting tooth and nail to escape our traditional credit sales business approach, which involved providing our Group's products and services through member merchants and dealers, as they do what they can to achieve the vision we are aiming for.

Last year, we revised our Corporate Philosophy for the first time in 30 years, and this year marked the launch of our new Medium-Term Management Plan. The path we must walk as a Group is clear. We will ensure that each employee is on board with this strategy and does everything in their power to achieve it so that we can get back on a growth trajectory.

I pledge to lead the reformation to ensure our stakeholders are able to truly perceive the "new Orico" in action. I look forward to your ongoing support in this regard.

Profile

| April 1987 | Joined the current Mizuho Bank, Ltd. |

|---|---|

| April 2012 | General Manager of the Osaka Branch of Mizuho Bank, Ltd. |

| April 2014 | Executive Officer of Mizuho Financial Group, Inc. and General Manager of Financial Planning Department |

| April 2017 | Managing Executive Officer of Mizuho Financial Group, Inc. and Head of Financial Control & Accounting Group |

| April 2022 | Director and Deputy President & Senior Executive Officer (Representative Executive Officer) of Mizuho Financial Group, Inc. Chief Digital Innovation Officer and Head of Financial Control & Accounting Group |

| April 2023 | Director, Deputy President & Senior Executive Officer (Representative Executive Officer) and Group CDO of Mizuho Financial Group, Inc. |

| April 2024 | Executive Vice-President Executive Officer of our Company |

| April 2025 | President and Representative Director of our Company(current position) |