Investor Relations(IR)

Integrated Report

Orico's Growth StrategyFrom a Business Perspective Bank Loan Guarantee Business

Since 1983, we have been collaborating with financial institutions to provide personal loan guarantees.

We pride ourselves on being among the top in the industry in the number of trading partners and help bolster the retail divisions of financial institutions with our extensive know-how nurtured in the credit business.

| Purpose Loan Guarantee | We also provide guarantee collaboration products that respond to the needs of customers with specific funding purposes. Our Company guarantees “purpose loans” from financial institutions such as auto loans, educational loans, and housing renovation loans. |

|---|---|

| Free Loan Guarantee | We offer guarantee collaboration products that respond to a wide range of our customers' immediate financial needs, allowing for the freedom of funds usage. We guarantee free loans from financial institutions of the certificate loan type. |

| Card Loan Guarantee | A guarantee collaboration product that promptly meets the diverse financial needs of our customers. We guarantee financial institutionsʼ card loans, which can be repeatedly used within the credit limit. |

Medium- to Long-Term Vision of the Company

Through our bank loan guarantee business, we act as a partner who shares the risks for financial institutions providing personal loans while simultaneously meeting the needs of individual customers beyond our immediate reach, thus facilitating the smooth provision of funds. In doing so, we enliven and enrich the lives of residents in the region. To fulfill this role, in our medium-term management plan, we have established “becoming a power that supports the region” as the mission of our division, and we will tackle the expansion of business domains and solving social issues through trial and error.

Moreover, our Company is in an alliance with 565 financial institutions of various types and sizes across the country. To provide timely solutions for the diverse range of issues faced by financial institutions, their customers, and regions, we collaborate with business partners that have strengths in innovative ideas and business models. In the midst of a drastically changing environment for financial institutions, we aim to improve profits by being "the guarantee company of choice" as a business partner that can face the business challenges of financial institutions and provide diverse solutions. This includes not only personal loan guarantees, but also for DX promotion, personnel development, operational efficiency, further support for clients, and business domain expansion.

Social Issues to be Addressed through Business Activities

Against the backdrop of a declining birthrate and aging society as well as a shrinking population, the nationwide problem of vacant houses is becoming more severe, especially in areas with aging populations. The number of vacant houses continues to increase, which could potentially have a serious impact on local residents' living environments in terms of disaster prevention, hygiene, and scenery, and dealing with this issue is a major challenge for local governments. To solve this social issue, our Company, in collaboration with AKIYA KATSUYO Co., Ltd. and local governments, has built a framework to promote the utilization of vacant houses through support ranging from cultivating understanding of the actual situation to promoting utilization. It then launched it as a platform available nationwide in March 2023 by commercializing Akikatsu Loan in cooperation with local financial institutions. We will encourage an increase in the number of people involved in each region and ultimately revitalize local economies. In addition, for traditional purpose loan products, we are developing products from the perspectives of decarbonization and SDGs, and in fiscal year 2022, we began offering SDGs-compatible EV auto loans, educational loans, and housing renovation loans with The Ehime Bank, Ltd.

Medium to Long-Term Market Outlook

Now that Japanʼs population is decreasing, considering the penetration of the sharing economy, the shift from material consumption to experience consumption, and other factors, the environment is not one where unsecured personal loan balances will continue to rise. Moreover, considering the intergenerational and interregional transfer of financial assets through inheritance that will occur into the future, it cannot be denied that relying solely on the traditional expansion of personal loans for guarantee business leaves little room for growth as a business. We will continue to develop new products with financial institutions with an emphasis on satisfying the needs and convenience of customers who use personal loans, while also taking into consideration individual life plans and regional characteristics. We are also working to expand the scope of the guarantee business, such as through small corporate loan guarantees for startups and guarantee provisions for business loans in collaboration with local governments.

Features of the Business and Market Superiority

With 40 years of experience in the bank loan guarantee business, our Company possesses credit expertise and a network with 565 affiliated financial institutions across the nation. We maintain a strong guarantee balance regardless of the type, such as regional banks, credit cooperatives, and credit unions, thus sustaining a high market share. We will continue to emphasize our nuanced responsiveness to customers and our ability to address financial institutions' management challenges beyond bank loan guarantees, working to differentiate ourselves from competitors.

| Strengths |

|

|---|---|

| Weaknesses |

|

| Opportunities |

|

| Threats |

|

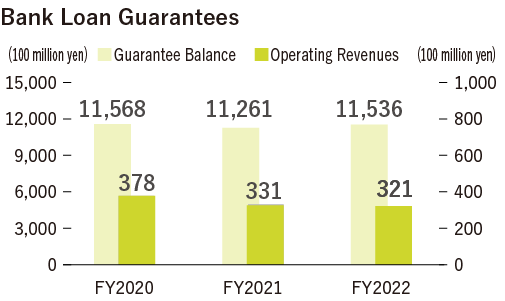

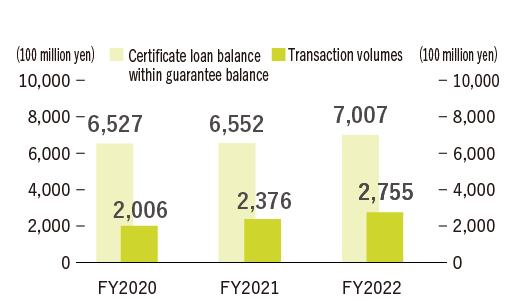

Overview of Fiscal Year 2022

Through market-in type of sales, we succeeded in continual engagement with 28 financial institutions to initiate new loan handling, among other problem-solving efforts, thus leading to an increase in the guarantee balance for the first time in five terms from the previous term end backed by steady growth in the transaction volume for certificate loans. We will work to increase revenue through enhanced profitability going forward.

Highlights in Fiscal Year 2022

We have been providing a pre-assessment service utilizing our assessment and guarantee know-how for the "crowd loan" platform aimed at connecting customers considering personal loans with financial institutions, with the goal of improving customer convenience. In May 2022, we formed a capital alliance with CrowdLoan Inc., which operates the platform. This has allowed us to further increase the number of affiliated financial institutions and acquire new digital application channels, and we are also utilizing this platform in the framework of the aforementioned Akikatsu Loan.