Investor Relations(IR)

Integrated Report

Orico's Growth Strategy From a Business Perspective Credit Cards and Cash Loans Business

Orico's credit card lets customers enjoy safety, security, and convenience. We accommodate a wide range of customer needs with attractive point programs and a variety of co-branded credit cards.

| Official Card | We offer services that excel in functionality to meet a wide range of customer needs, such as Orico Card THE POINT, which has a high point reward rate of one Orico point for every 100 yen spent using the card and has no annual fees. |

|---|---|

| Co-branded Credit Cards | We offer cards that meet customer needs in partnership with business partners, such as Mizuho Mileage Club Card/THE POINT, EDION Card, and Costco Global Card. Currently, we have about 1,500 types in our co-branded credit card lineup and continue to provide attractive services to customers. |

Medium- to Long-Term Vision of the Company

The environment surrounding the payment industry is changing daily due to technological advancements and the impact of COVID-19 on lifestyles. While society is expected to see an increased shift toward cashless transactions in the medium-to long- term amid these environmental changes, our mission is to provide value of safety, security, convenience, and enjoyment to our customers through our credit card business. Beyond common point redemption schemes and special coupons, we plan to provide personalized services to approximately 11 million credit card users and approximately 4 million customers using our auto loans through our digital communication platform "e-Orico", which is scheduled for a complete overhaul. Moreover, we will dramatically change the customer experience in card applications and usage by developing products and services utilizing digital technology, such as performance-based credit, which we were the first major credit card company to implement, and digital cards on smartphones, and so on.

Social Issues to be Addressed through Business Activities

In the credit card industry, fraud is becoming more common, especially in online transactions on e-commerce sites. Strengthening fraud prevention measures is an industry-wide challenge. We are committed to creating an environment where customers can use credit cards with confidence by implementing various measures, such as incorporating AI functionality into fraud detection systems and enhancing personal authentication services through the implementation of one-time passwords.

In addition, although the percentage of individuals in the payment market using cashless transactions is steadily growing, improving the low percentage of cashless transactions for corporations is extremely important from the viewpoint of enhancing the productivity of the Japanese economy. To address this issue, we are actively promoting the Orico Business payment for SME (OBS), an invoice card payment service for business-to-business transactions. We will continue to expand our service lineup to contribute to the DX of accounting operations of small- and medium-sized enterprises and sole proprietors.

Medium to Long-Term Market Outlook

As technology makes rapid advances and the digital native generation expands its presence in society, the customer experience in the payment scene is likely to undergo a dramatic transformation. Just as we could not have imagined the widespread use of QR code payments* just 10 years ago, it is not easy to envision what the payment market will look like 10 years from now. Currently, credit cards, which account for over 80% of cashless payments, may not maintain the market position. However, one thing we can say is that the cashless trend will continue to advance in the payment market for both individuals and corporations. We expect the entry of FinTech companies and companies from different industries to continue. In this expanding and evolving payment market, our Company possesses assets such as domestic and overseas payment networks built on long experience, credibility, advanced security, and extensive human resources. We aim to reap the fruits of the market's growth by refining our services in our economic sphere to be safe, secure, convenient, and enjoyable, and by providing necessary payment functionality to new entrants.

* QR code is a registered trademark of DENSO WAVE INCORPORATED.

Features of the Business and Market Superiority

We boast a network of 850,000 member merchants, around 11 million credit card users, and approximately 4 million customers utilizing installment credits such as auto loans. Through the full-scale enhancement slated for e-Orico aimed at fostering digital communication and providing innovative products and services using technology, we seek to create a new experience value for our customers, deepening our connection with customers in the Orico Economic Zone.

| Strengths |

|

|---|---|

| Weaknesses |

|

| Opportunities |

|

| Threats |

|

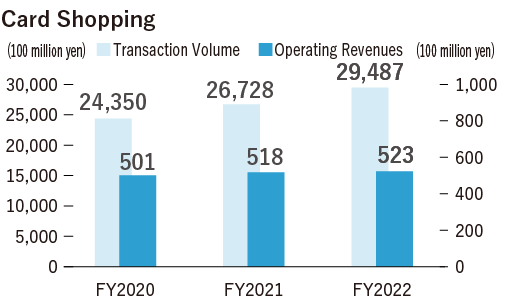

Overview of Fiscal Year 2022

The card shopping handling amount continues to grow, increasing by 10% YoY through the promotion of large-scale co-branded credit cards related to daily life, and further expansion is expected.

Highlights in Fiscal Year 2022

In collaboration with eight new partnering companies, we have launched a number of co-branded credit cards that primarily target younger generations, including the "cheeky SBI e-Sports card", the "BLUELOCK Orico card", and the "CAPCOM Orico Card: Dragon's Dogma" associated with the popular game series.

Moreover, we are accelerating new business ventures such as a collaboration with SBI SECURITIES Co., Ltd. for individual asset management services and development of OBS invoice card settlement service for business-to-business transactions.