Investor Relations(IR)

Integrated Report

Orico's Growth StrategyFrom a Business Perspective Message from Head of Finance Group

Balance financial soundness, shareholder returns, and capital

efficiency while increasing asset efficiency and moving toward

sustainable growth

Managing Executive Officer

Head of Finance Group Masahiro Kosugi

Review of Fiscal Year 2022 and Prospects for Fiscal Year 2023

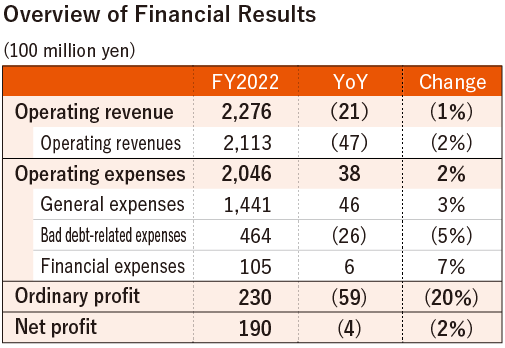

In fiscal year 2022, amidst continued uncertainty about the future, some signs of recovery in personal consumption were observed. However, interest rates rose more than anticipated, due in part to the Bank of Japan's monetary policy adjustment in December 2022. Operating revenue declined by 1% YoY to 227.6 billion yen. The decrease was mainly attributed to the reduction in securitization revenue following the interest rate hike, causing a significant decrease in the installment credit business. Ordinary profit decreased by 20% to 23 billion yen, and the profit attributable to owners of parent decreased by 2%, amounting to 19 billion yen. That being said, we believe we have been able to minimize the damage from the interest rate rise through successful expansion in the settlement and guarantee business and overseas business, key areas of the medium-term management plan, as well as through flexible real estate sales and containment of expenses relative to plan.

For fiscal year 2023, we are forecasting an increase in ordinary profit to 25 billion yen and profit attributable to owners of parent to 20 billion yen. While the impact of rising interest rates will present a challenge throughout the year, we are planning to accumulate revenue through further growth in our settlement and guarantee business and overseas business, and by incorporating the recovery from the pandemic into our credit cards and cash loans business and bank loan guarantee business. Looking toward achieving 40 billion yen or more in ordinary profit in the final year of the medium-term management plan, we will take firm steps to execute four key strategies and fundamentally reform the revenue structure of the installment credit business.

Stable and Efficient Fundraising

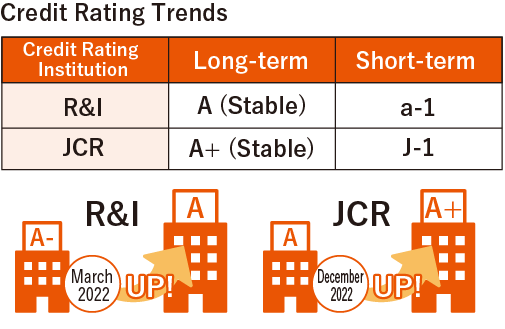

With regard to fundraising, there are a number of options, including borrowing from financial institutions, securitization of receivables, credit guarantees, corporate bonds, and commercial paper. We are striving to maintain an optimal balance by utilizing diverse channels, with a focus on stable and efficient funding operations. In particular, looking ahead to potential interest rate hikes, we are progressing toward a fixed funding ratio of approximately 80% for interest-bearing liability. Concerning fundraising itself, there are no worries in this area thanks to credit rating upgrades and our favorable relationships with financial institutions. While there may be a need for new funds to support future growth investments, we will continue to fine-tune our cash holdings, which were kept robust during the pandemic.

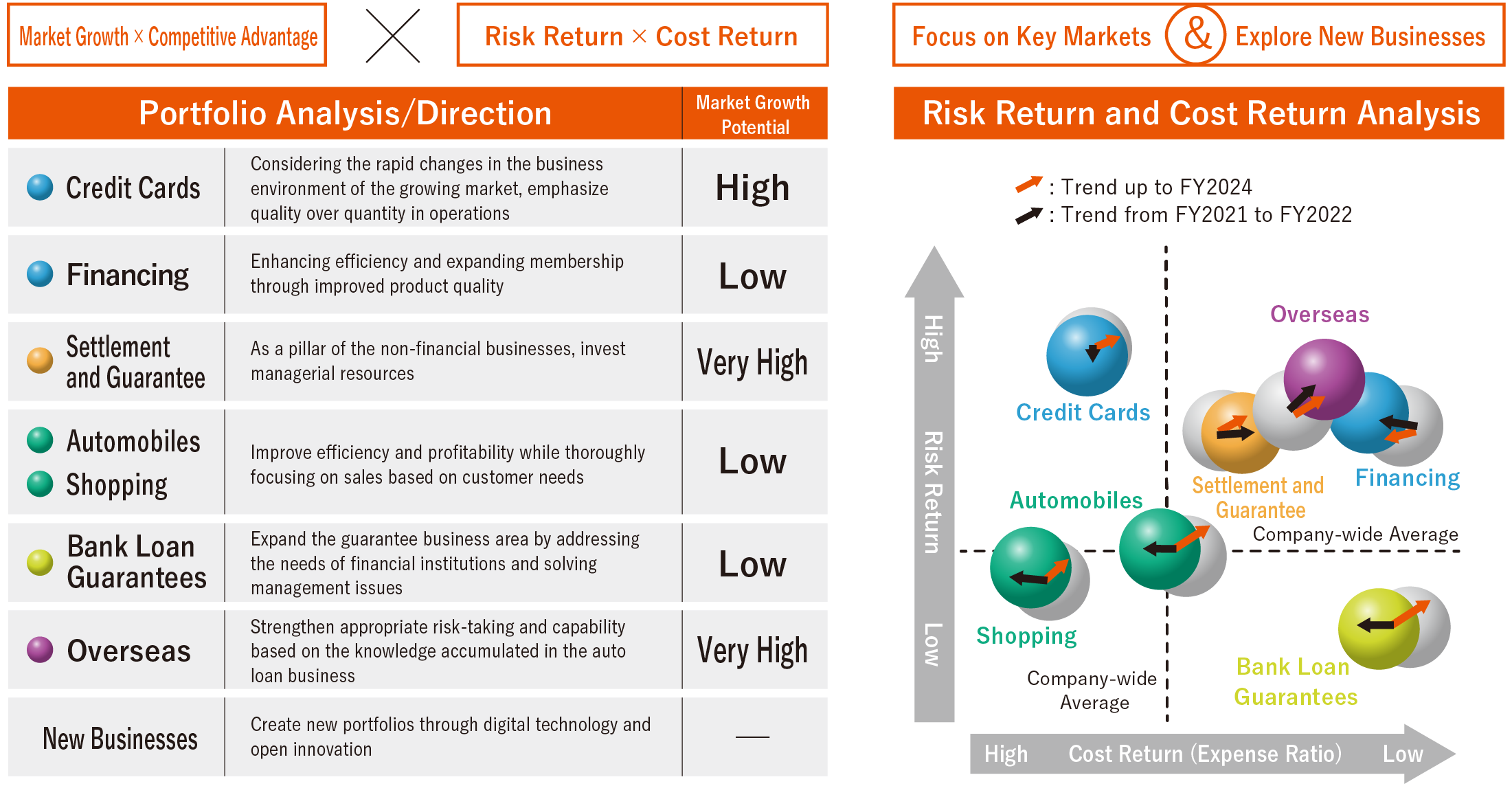

Business Portfolio Management

We began business portfolio management in fiscal year 2022. Under the seven business portfolios, we created further segmented sub-portfolios, then analyzed the medium- to long-term trends for each business and designated the future directions as “concentrate”, “maintain”, or “reduce” based on the two axes of risk return and cost return. We are actively discussing the allocation of managerial resources and future business strategies. Along with business portfolio management, we have also been making progress on implementing a system of management accounting by division. We are working out the relationships between individual management figures and our P&L and are tracking the progress of results for the fiscal year. These efforts are also contributing to a transformation in the sales-oriented mindset that was prevalent in certain areas.

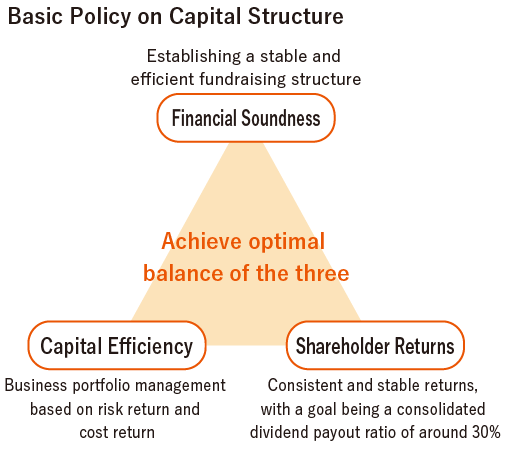

Capital Structure Policy

In fiscal year 2022, we formulated a new Basic Policy on Capital Structure that entails striking a balance between financial soundness, shareholder returns, and capital efficiency. For shareholder returns, we will aim for a consolidated dividend payout ratio of 30%, based on stable and continuous shareholder returns. In the implementation of our capital structure policy, improving asset efficiency is essential. To this end, we are concentrating on our high asset efficiency settlement and guarantee businesses, as well as our overseas business. We are also focusing on building a foundation that can efficiently raise revenue through engagement in non-interest businesses in the Business Promotion Division, combined with reforming the revenue structure of the installment credit business.

To Our Valued Stakeholders

Under the present medium-term management plan, our goal is to address social issues through our business while enhancing profitability. In alignment with this approach, we believe that demonstrating solid growth and profitability will increase the trust stakeholders have in our Company and be reflected in stock prices, among other areas. We are committed to making efforts to become a sustainable company 20 or 30 years from now as well, and we would be grateful for your continued support.