Investor Relations(IR)

Integrated Report

Orico's Growth StrategyFrom a Business Perspective Installment Credit Business

As a pioneer and leading company in the consumer finance industry, we provide various types of credit in collaboration with member merchants, catering to our customers' needs and lifestyles.

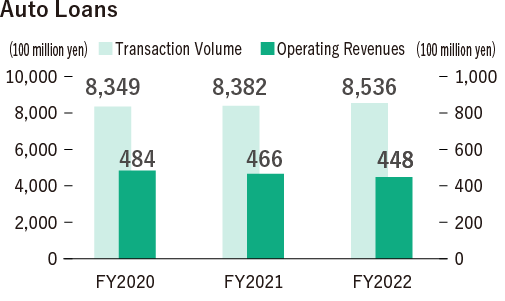

| Auto Loans | We boast top-level market share in the industry. We address the extensive needs of our customers by developing unique products that enrich their lives after purchasing cars. |

|---|---|

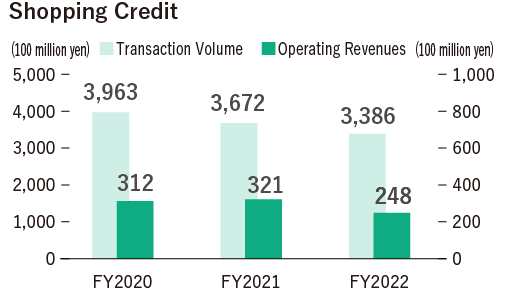

| Shopping Credit | We aspire to be of service across a broad spectrum of our customers' lifestyles, enabling them to utilize various products and services via credit. |

| Home Renovation Loans | Home renovation loans are available for various improvements, including home expansion and renovation costs and household appliance purchases. We also accommodate purchases of items such as all-electric systems and solar power generation systems and storage batteries. |

Medium- to Long-term Vision of the Company

Our installment credit business, through auto loans, shopping credit, and other features, has been providing a wide range of products and services that match customer and market needs in line with the changing of the times, with the aim of embodying our brand slogan "standing by your side, helping dreams come true". We will continue to stay abreast of global and technological advancements and respond to anticipated market changes, values, and other factors. This will allow us to provide safe, secure, and convenient financing based on customer needs, as well as to collaborate with our member merchants, who are our business partners, to create a healthy market.

Under our medium-term management plan slogan of "Transformation Now! Becoming a financial services group for a new era that creates value from the customer's perspective", we will depart from the conventional credit sales model and apply the ideas of "Green", "Digital", and "Open Innovation" to create new value and contribute to solving societal challenges such as achieving a decarbonized society, improving productivity, all while simultaneously improving corporate value.

Social Issues to be Addressed through Business Activities

In addition to auto loans, for which we boast industry-leading transaction volumes, our Company offers shopping credits that support various life events of our customers. These include home renovation, tuition, driving license acquisition costs, bridal-related expenses, and more. Through the installment credit business, we are actively working on the development of financial products and services that promote the use of renewable energy such as EVs, residential solar power systems, and storage batteries, with the goal of contributing to the realization of a decarbonized and circular society. For example, in November 2022, we invested in EV fabless manufacturer ASF Inc., and we will help achieve a decarbonized society by promoting the introduction of EVs to customers nationwide through our group company, ORICO AUTO LEASING, as well as collaborating with ASF Inc.'s supply chain. Also, regarding set loans consisting of environmental products including EV and V2H products developed in February this year, we are advancing collaboration in new areas and supporting the spread of environmental products through a comprehensive business alliance with NICHIRON CORPORATION, a leading V2H company. Furthermore, by expanding home renovation loans and rent settlement guarantees, we will contribute to the development of local communities by alleviating various people's anxiety about living.

Going forward, each of us will be more aware than ever of the importance of solving social problems through our business activities, and we will work to deliver products and services that are in touch with our customers, while drastically changing the way we approach things and the way we do business.

Medium to Long-Term Market Outlook

There is a possibility that the movement towards decarbonization could accelerate on a global scale beyond our expectations. We also consider the impact on our Company from the worsening of the declining birthrate and aging society in Japan to be significant. We will actively take measures by identifying risks and opportunities, primarily in our core auto loan business, and also view the changes as business opportunities to create new businesses.

We will also work together to solve social issues such as a shortage of successors at our business partner member merchants. Going forward, we predict that the financial environment will enter a phase of rising interest rates. In the installment credit business, it is urgent that we shift toward a long-tail business model that focuses on profitability more than expanding the transaction volume. We will channel this into enhancing profitability through radical structural reforms using digital technology.

Business Features and Market Superiority

We are engaged in market-in type of sales via our nationwide network of sales branches, which enables us to provide the best solutions promptly without being confined to existing domains. We do this by harnessing region-based agile operations, scalability, and by proposing a wide range of products and services. We also boldly embrace changes in laws and regulations in line with trends in decarbonization initiatives and digital transformation, viewing them as new business opportunities.

| Strengths |

|

|---|---|

| Weaknesses |

|

| Opportunities |

|

| Threats |

|

Overview of Fiscal Year 2022

Although the volume of auto loan transactions was affected more than expected by constraints in supply, such as a semiconductor shortage for new cars, it remained at the previous year's level due to an increase in used car transactions. The volume of shopping credit transactions decreased YoY owing to factors such as a reduction in the volume of home renovation loans due to construction delays caused by material shortages.

Highlights in Fiscal Year 2022

As the inaugural project of the Orico Sustainability Fund, we have entered into a capital and business alliance with ASF Inc., as well as a comprehensive business partnership with NICHICON CORPORATION commencing collaboration with new business partners for sustainable growth. In terms of product development, we secured a business model patent for “O-Lai!” and, as previously mentioned, achieved tangible results such as the release of set loans for environmental materials, inclusive of EVs and V2H.