Investor Relations(IR)

Integrated Report

Orico's Growth StrategyFrom a Business Perspective Overseas Business

Capitalizing on our top-class performance and expertise with auto loans in Japan, we will contribute to the healthy growth of the new and used car market in Southeast Asia by offering financial services tailored to local needs.

| Thailand | We established an operating company in 2015 to offer used car loans and related products to customers in major urban areas, including Bangkok. |

|---|---|

| Philippines | In 2019, we established an operating company, expanded our sales network centered in Manila, and provided used car loans to our customers. |

| Indonesia | In 2021, we acquired shares of a loan company and are offering new and used car loans. We launched a new certified used car scheme in 2023. |

Medium- to Long-Term Vision of the Company

It has been eight years since we focused on expanding our auto loan business in the ever-growing Southeast Asia market, launching operations in Thailand in 2015 and the Philippines and Indonesia thereafter. The middle-income class continues to grow in these countries, and consumption is steadily expanding. Under these conditions, we intend to leverage our domestic expertise in auto loan businesses to expand our sales network, enhance our product offerings, and elevate our financial service capabilities, thereby boosting Oricoʼs brand recognition in each country.

Additionally, with the accelerated development of digital technology and the establishment of communications infrastructure, financial inclusion is becoming more widespread. We aim to help our customers lead prosperous lives and foster the development of sustainable communities by providing safe, secure, and convenient financial services that meet our customers' needs. We are also exploring the possibility of designating Vietnam as our fourth auto loan market, all while initiating new businesses in countries where we are already present and further extending our overseas operations.

Social Issues to be Addressed through Business Activities

As responding to climate change becomes an immediate global concern, the three countries we have entered are undertaking more aggressive, government-run measures towards EV adoption, even more so than Japan. Although Korean and Chinese automobile manufacturers currently has a strong presence in EV offerings, we believe that the full-scale deployment of EVs by Japanese car manufacturers will create opportunities for our overseas business to branch into the EV sector. We commenced a certified used car scheme in Indonesia in March 2023, aiming to contribute to further growth in the automotive market. This is achieved by creating a market for consumers in Asia to purchase safe and reliable used cars, and by promoting the "reuse" of high-quality Japanese vehicles, which hold more than a 90% share in the Southeast Asian market. Moving forward, we will continue to contribute to the entire development of the Southeast Asian automobile market by exploring the creation of used car markets with certified processes in active personal used car trading markets. Furthermore, we will help to enrich our customers' lives by offering the financial services and new products beyond auto loans most suitable for each country.

Medium to Long-Term Market Outlook

Looking at the global new car sales market, developed countries, including Japan, have been saturated since the 2010s.

On the other hand, in the five major Southeast Asian countries, the GDP is expected to grow at an average annual rate of 3% until the 2030s, and new car sales, including for EVs, are expected to increase significantly. In proportion to this increase, the need to purchase automobiles is expected to rise with the increase in consumer income, and the auto loan market is expected to expand further. However, at the moment, there is a need to be mindful of economic trends such as higher-than-expected interest rate increases, the rise in inflation, and a global economic slowdown, which have led to economic slowdowns in the five major Southeast Asian countries and a decline in consumer spending.

Nevertheless, the GDP growth rate in the five major Southeast Asian countries continues to grow steadily, and with the diversification of consumer lifestyles in the post-COVID-19 era, financial services are evolving in a leapfrog manner due to the dramatic spread of digital technology and infrastructure, and consumer usage is expanding. We will firmly acknowledge this trend and continue to provide auto loans, new products, and services that enhance customer convenience, as well as expand our overseas business.

Features of the Business and Market Superiority

While tailoring the expertise of our auto loan business, honed in Japan, to fit various overseas markets, we are embracing the challenge of expanding our business into previously untapped markets.

| Strengths |

|

|---|---|

| Weaknesses |

|

| Opportunities |

|

| Threats |

|

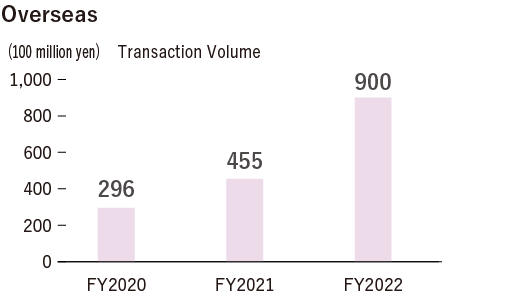

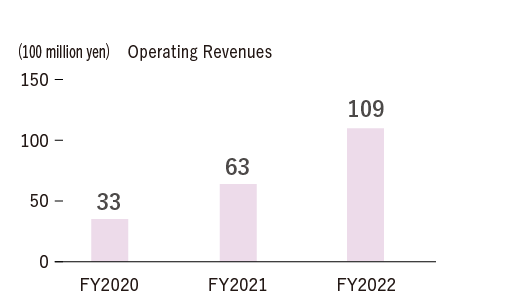

Overview of Fiscal Year 2022

The overseas auto loan business witnessed a substantial increase in transaction volumes across all countries, including Thailand (up 70% YoY), the Philippines (up 95%), and Indonesia (up 230%), spurred by economic recovery from the pandemic and enhancement of the management foundation.

Highlights in Fiscal Year 2022

Beginning in March 2023, we initiated the "certified used car scheme" in Indonesia. In Southeast Asia, where vehicle inspection is limited and there is no quality assurance for used cars, we are utilizing our experience in used car assessments to design a system to cultivate the used car market and boost the auto loan transaction volume. Also, for the first time in the credit industry, we have also formulated a Sustainability-linked Financing Framework, establishing auto loan volumes in Southeast Asia as a key performance indicator (KPI).