Sustainability

Climate Change and Natural Capital Conservation Initiatives

Amid heightened awareness of the risks posed by climate change and the need to conserve natural capital, demands for corporate action on environmental issues are rapidly increasing. We recognize the importance of our contribution to achieving a sustainable economy, especially in light of our presence in secondhand, reuse, and other markets. We have identified "Contributing to the Realization of a Circular Economy and Decarbonization" as one of our materailities-important issues to be addressed as a priority. We are advancing our efforts to achieve said materiality by leveraging the business expertise cultivated in our core businesses and creating new business opportunities. Specifically, we aim not only to reduce environmental impacts arising from mobility and housing, but also to support the transition to a circular economy and help encourage ethical consumption. We are promoting collaboration with our business partners to realize a circular society and decarbonization, with the aim of passing on a sustainable society to future generations.

We are also implementing a variety of initiatives to reduce the environmental burden of our business operations.

Our Group's disclosure on environmental matters, including climate change and natural capital conservation, is organized under the topics of Governance, Strategy, Risk Management, and Metrics and Targets.

Disclosure of Information Based on Four Key Elements

Governance

Our Group believes that ensuring management transparency, fairness toward stakeholders, and swift, decisive decision-making is essential. In light of the Group's management environment, we are working to enhance our corporate governance.

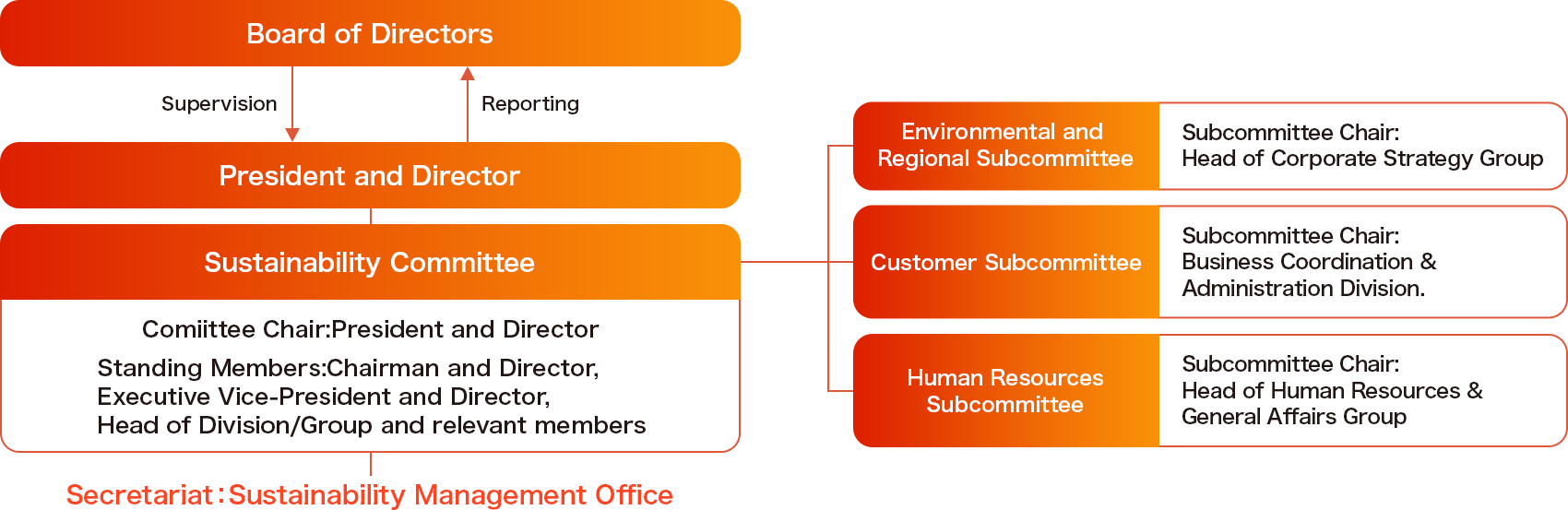

Regarding the importance of the risks and opportunities related to climate change and natural capital conservation, as well as dependencies and impacts on nature within our business strategies, we have established a structure for discussion and reporting through the Sustainability Committee, chaired by the President and Director.

We have also established our Environmental Basic Policy and are working to improve its effectiveness by implementing the PDCA cycle, including planning, execution, and reporting in line with this policy.

Progress on these environmental initiatives is reported appropriately and as needed to the President and Director and the Board of Directors, which provides oversight of our Group's initiatives on climate change and environmental matters.

Strategy

In the Medium-Term Management Plan, we have positioned sustainability as a high-level management strategy concept that is at the heart of management. In this context, we defined materialities as important issues to be addressed as a priority in achieving our Envisioned Society and Vision in 10 years' time and formulated key strategies to solve these key issues using the backcasting approach. One of the materialities is "Achieving a Decarbonized and Circular Society", and we aim to contribute to solving social issues, including climate change and natural capital conservation through the steady implementation of our key strategies.

Scope

Evaluation was conducted for our consolidated group.

Process for Evaluating and Managing Climate Change, Natural Capital, and Other Environment-Related Risks, Opportunities, Dependencies, and Impacts

We have conducted scenario analyses in line with the framework proposed by the Task Force on Climate-related Financial Disclosures (TCFD) to assess the potential impacts on our Group of environmental issues such as climate change, as well as the transition to a circular society and decarbonization. Additionally, we conducted analyses of natural capital conservation and ecosystems using the Locate, Evaluate, Assess, and Prepare, or LEAP, approach recommended by the Taskforce on Nature-related Financial Disclosures, or TNFD.

In scenario analysis and in specific evaluation and management processes, the Sustainability Management Office in the Corporate Planning Dept. works in collaboration with relevant divisions to: (1) identify environmental risks and opportunities and dependencies and impacts, including those related to climate change and natural capital; (2) evaluate these items; and (3) consider appropriate countermeasures. In managing the identification and evaluation of risks, opportunities, dependencies, and impacts, we not only assess each element individually but also take into account their interrelationships. For example, we consider how changes in dependencies may give rise to new risks, or how one opportunity may amplify another impact. In this way, we aim to understand overall synergies and trade-offs and respond accordingly.

These matters are also discussed by the Sustainability Committee. Officers who serve as standing members of the committee, along with directors and other members of management, participate in the evaluation and consideration of countermeasures. This ensures that our Group promotes effective, Group-wide responses to environmental issues.

Definition of Time Horizons (Short, Medium, Medium-to-Long, and Long Terms)

To enable responses aligned with international frameworks, we have defined the timing of occurrence and the timing at which impacts materialize using the following time horizons:

- Short term: Present–FY2027

- Medium term: FY2028–FY2032

- Medium-to-long term: FY2028–FY2043

- Long term: FY2033–FY2052

Definition of Possibility of Occurrence (High, Medium, Low)

By integrating public information, expert information, and internal intelligence, we have set three levels of risk possibility: high, medium, and low. We evaluate the likelihood of occurrence by considering the progress of response measures and other factors.

High: High probability of occurrence

Medium: Possibility of occurrence but cannot be confidently predicted

Low: Low probability of occurrence

Definition of Impact Level

Our Group defines the level of impact that risks and opportunities may have on business operations in financial terms, using the following categories. Each risk or opportunity is evaluated based on these levels. The impact value for risks and opportunities and the magnitude for dependencies and impacts represent the cumulative total for FY2025 to FY2029. However, events that had not yet occurred as of July 2025, when the calculations were made, are excluded from the calculations.

Thresholds for impact values were set with reference to the Tokyo Stock Exchange disclosure criteria for performance forecast revisions, based on our Group's actual performance in FY2024, and then rounded to the nearest whole number.

- High impact: 10% or more of transaction volume, operating revenue, or guarantee balance

- Medium impact: 5% or more but less than 10% of transaction volume, operating revenue, or guarantee balance

- Low impact: Less than 5% of transaction volume, operating revenue, or guarantee balance

The definitions of the accounts and amounts used for the impact value, and the classification of their use, are as follows:

- Operating revenue: Revenue derived from primary business activities (sales) -> Used to indicate the direct impact on our Group's business

- Bank loan guarantee balance: Guarantee balance from our bank loan guarantee business -> Used to indicate the impact on our bank loan guarantee business

- Installment credit transaction volume: Transaction volume from our installment credit business -> Used to indicate the impact on our installment credit business

| Operating Revenue | Bank Loan Guarantee Balance | Transaction Volume of Installment Credit |

|

|---|---|---|---|

| High | Over 23 billion yen | Over 140 billion yen | Over 130 billion yen |

| Medium | From 11 billion yen to less than 23 billion yen | From 69 billion yen to less than 140 billion yen | From 130 billion yen to less than 63 billion yen |

| Low | Less than 11 billion yen | Less than 69 billion yen | Less than 63 billion yen |

Scenarios Used for Analysis

To accurately understand the impact of climate change on our business to the greatest extent possible, we used the following two scenarios:

- 1.5°C Scenario

This scenario limits the temperature rise by the end of the 21st century to about 1.5°C compared to pre-industrial revolution levels.

It anticipates the emergence of risks and opportunities associated with the transition to a circular society and decarbonization, such as tighter GHG emissions regulations and a shift toward a circular economy. - 4°C Scenario

This scenario anticipates a temperature rise of about 4°C by the end of the 21st century compared to pre-industrial revolution levels.

It predicts an increase in severe disasters due to sea-level rise and extreme weather conditions.

We have used the 1.5°C scenario as the basis for risk and opportunity analysis and set reduction targets aimed at achieving carbon neutrality by 2050. However, for "Business continuity risk due to increased extreme weather conditions, such as typhoons and heavy rains (physical risk)" under the Recognition of Risks and Opportunities, we have adopted the 4°C scenario to analyze and calculate impact values in preparation for the worst-case scenario.

For natural capital and ecosystem-related analysis, we refer to TNFD guidance on scenario analysis and conduct evaluation, analysis, and response measures based on the LEAP approach recommended by the TNFD.

Analysis Related to Natural Capital and Ecosystems Using the LEAP Approach

Our Group recognizes forests and other forms of natural capital as the foundation for the well-being of all stakeholders, including our customers, business partners, executives, and employees.

We make ongoing efforts to achieve harmonious coexistence with natural capital and ecosystems such as forests, and have conducted the following analysis of natural capital and ecosystems using the LEAP approach.

Identification of Priority Areas

To identify priority areas for our Group, we verified whether any of our sites are located in or near areas of concern by cross-referencing with the Key Biodiversity Areas (KBA) database and other sources.

Our Group operates throughout Japan and in Southeast Asia (Thailand, the Philippines, and Indonesia). As a result of this screening, we confirmed that one of Our Group's business sites is located in close proximity to the following KBA:

- Lake Nakaumi (Matsue City, Shimane Prefecture)

At this site near the identified KBA, we recognize that, given the nature of Our Group's business, our operations do not have a significant impact on the surrounding environment. However, we will continue to monitor the situation closely and work to mitigate risks.

Identification and Evaluation of Dependencies and Impacts on Nature

We use the Exploring Natural Capital Opportunities, Risks and Exposure (ENCORE) tool to generate heat maps showing the categories and magnitude of dependencies and impacts associated with our Group's primary businesses. Dependencies and impacts not listed in ENCORE are also taken into account during identification and evaluation, based on their importance to our business operations.

Heat Map of Dependencies and Impacts in Our Group's Business Areas Using ENCORE

The heat map below shows the dependencies and impacts in our Group's business areas based on ENCORE. In consideration of the nature and scale of our Group's business, we make adjustments in the evaluation process such as contextualizing the degree of dependency or impact in cases where exposure is limited.

Heat Map of Dependencies and Impacts Related to Nature

![Dependency Heatmap Chart. [Resource Reservation Service],[Water supply] [Other provisioning services - Animal-based energy]. [Regulating and maintenance service],[Global climate regulation services],[Rainfall pattern regulation services (at sub-continental scale)],[Local (micro and meso) climate regulation services],[Air filtration services],[Soil and sediment retention services],[Water flow regulation services],[Flood mitigation services],[Storm mitigation services],[Noise attenuation services],[Biological control services],[Other regulating and maintenance service - Mediation of sensory impacts (other than noise)]. [Cultural Services],[Recreation-related services],[Visual amenity services],[Education, scientific and research services]. [Renting and leasing of motor vehicles column][Local (micro and meso) climate regulation services column] L,[Renting and leasing of motor vehicles column][Soil and sediment retention services column] L,[Renting and leasing of motor vehicles column][Water flow regulation services column] L,[Renting and leasing of motor vehicles column][Flood mitigation services column] M,[Renting and leasing of motor vehicles column][Storm mitigation services column] L,[Renting and leasing of motor vehicles column][Recreation-related services column] L,[Renting and leasing of motor vehicles column][Visual amenity services column] L,[Renting and leasing of other machinery, equipment and tangible goods column][Local (micro and meso) climate regulation services column] L,[Renting and leasing of other machinery, equipment and tangible goods column][Water flow regulation services column] L,[Renting and leasing of other machinery, equipment and tangible goods column][Flood mitigation services column] M,[Renting and leasing of other machinery, equipment and tangible goods column][Storm mitigation services column] M,[Renting and leasing of other machinery, equipment and tangible goods column][Recreation-related services column] L,[Renting and leasing of other machinery, equipment and tangible goods column][Visual amenity services column] L,[Renting and leasing of other machinery, equipment and tangible goods column][Education, scientific and research services column] L,[Real estate activities with own or leased property column][Local (micro and meso) climate regulation services column] L,[Real estate activities with own or leased property column][Soil and sediment retention services column] M,[Real estate activities with own or leased property column][Storm mitigation services column] L,[Real estate activities with own or leased property column][Visual amenity services column] L,[Real estate activities on a fee or contract basis column][Local (micro and meso) climate regulation services column] L,[Real estate activities on a fee or contract basis column][Soil and sediment retention services column] M,[Real estate activities on a fee or contract basis column][Storm mitigation services column] L,[Real estate activities on a fee or contract basis column][Visual amenity services column] M,[Insurance column][Local (micro and meso) climate regulation services column] L,[Other financial service activities, except insurance and pension funding activities column][Local (micro and meso) climate regulation services column] L,[Data processing, hosting and related activities; web portals column][Local (micro and meso) climate regulation services column] L,[Data processing, hosting and related activities; web portals column][Air filtration services column] L,[Computer programming, consultancy and related activities column][Local (micro and meso) climate regulation services column] L,[Other information service activities column][Local (micro and meso) climate regulation services column] L,[Office administrative and support activities column][Local (micro and meso) climate regulation services column] L,[Activities of call centers column][Local (micro and meso) climate regulation services column] L,[Activities of head offices column][Local (micro and meso) climate regulation services column] L,[Activities of head offices column][Storm mitigation services column] L.](/en/company/assets/imgs/sustainability/esginfo/03/img-esginfo-03-02.png)

![Impact Heatmap Chart. [Area of freshwater use],[Area of land use],[Area of seabed use],[Emissions of GHG],[Emissions of non-GHG air pollutants],[Emissions of nutrient pollutants to water and soil],[Emissions of toxic pollutants to water and soil],[Generation and release of solid waste],[Introduction of invasive species],[Volume of water use]. [Renting and leasing of motor vehicles column][Area of land use column] L,[Renting and leasing of motor vehicles column][Emissions of nutrient pollutants to water and soil column] L,[Renting and leasing of motor vehicles column][Emissions of toxic pollutants to water and soil column] L,[Renting and leasing of motor vehicles column][Introduction of invasive species column] L,[Renting and leasing of motor vehicles column][Volume of water use column] L,[Renting and leasing of other machinery, equipment and tangible goods column][Area of freshwater use column] L,[Renting and leasing of other machinery, equipment and tangible goods column][Area of land use column] L,[Renting and leasing of other machinery, equipment and tangible goods column][Area of seabed use column] L,[Renting and leasing of other machinery, equipment and tangible goods column][Emissions of nutrient pollutants to water and soil column] L,[Renting and leasing of other machinery, equipment and tangible goods column][Emissions of toxic pollutants to water and soil column] L,[Renting and leasing of other machinery, equipment and tangible goods column][Introduction of invasive species column] L,[Renting and leasing of other machinery, equipment and tangible goods column][Volume of water use column] L,[Real estate activities with own or leased property column][Area of land use column] L,[Real estate activities with own or leased property column][Emissions of toxic pollutants to water and soil column] L,[Real estate activities with own or leased property column][Volume of water use column] L,[Real estate activities on a fee or contract basis column][Area of land use column] L,[Real estate activities on a fee or contract basis column][Emissions of toxic pollutants to water and soil column] L,[Real estate activities on a fee or contract basis column][Volume of water use column] L,[Insurance column][Area of land use column] L,[Insurance column][Emissions of GHG column] L,[Insurance column][Emissions of toxic pollutants to water and soil column] L,[Other financial service activities, except insurance and pension funding activities column][Area of land use column] L,[Other financial service activities, except insurance and pension funding activities column][Emissions of GHG column] L,[Other financial service activities, except insurance and pension funding activities column][Emissions of toxic pollutants to water and soil column] L,[Data processing, hosting and related activities; web portals column][Area of land use column] M,[Data processing, hosting and related activities; web portals column][Emissions of GHG column] L,[Data processing, hosting and related activities; web portals column][Volume of water use column] L,[Computer programming, consultancy and related activities column][Area of land use column] M,[Computer programming, consultancy and related activities column][Emissions of GHG column] L,[Computer programming, consultancy and related activities column][Emissions of toxic pollutants to water and soil column] L,[Computer programming, consultancy and related activities column][Volume of water use column] L,[Other information service activities column][Area of land use column] M,[Other information service activities column][Generation and release of solid waste column] L,[Other information service activities column][Volume of water use column] L,[Office administrative and support activities column][Area of land use column] M,[Office administrative and support activities column][Volume of water use column] L,[Activities of call centers column][Area of land use column] M,[Activities of call centers column][Volume of water use column] L,[Activities of head offices column][Area of land use column] M,[Activities of head offices column][Volume of water use column] L.](/en/company/assets/imgs/sustainability/esginfo/03/img-esginfo-03-03.png)

Legend: L = Low, M = Medium

- *Assessments are made based on the results of the ENCORE screening, combined with a comprehensive review of both internal and external information. Specifically, items identified as very low (VL) during an initial screening are excluded from the scope of dependency and impact analysis. This takes into account that our Group's business activities mainly consist of office-based operations in the Other Financing Business sector, where environmental dependencies and impacts are limited. Additionally, we adjust the degree of dependency for items related to cultural services that were identified as very high (VH) during the initial screening. This is due to the low weight of such activities in our Group's business portfolio, and limited exposure to tourism or recreation-related industries (the basis for high dependency in cultural services). For example, our Group's auto leasing business primarily serves individuals and SMEs outside the tourism sector.

List of Dependencies and Impacts Recognized by Our Group

In our Medium-Term Management Plan (FY2025–FY2029), our Group has positioned cultivating circular economy market as one of its strategic pillars. As a retail financial services provider, we also recognize the dependency and impact of our operations on forest resources, such as paper and fixtures. Taking into account the heat map generated using ENCORE and the importance of these factors to our Group's business operations, we have organized our dependencies and impacts as follows.

List of Dependencies and Impacts

Scenario |

Category |

Dependency/Impact Scenario Details |

Orico's |

Magnitude of Dependency/Impact |

Countermeasures |

|---|---|---|---|---|---|

| Impact from disposal of used vehicles after lease | Impact | Regulatory changes and evolving consumer preferences accelerate the shift from ownership to usage. The market for services such as car leasing and car sharing expands, leading to an increase in the number of vehicles entering these markets | Vehicles at the end of their lease term may be improperly disposed of without proper management or undergoing appropriate disposal processes, potentially causing impacts such as environmental pollution | Approximately 100,000 tons | Establish and operate a scheme to extend vehicle life through proper inspection and maintenance during the lease term, enabling vehicles to be resold as high-quality used cars after the lease term *: Our Group promotes maintenance lease plans to stakeholders, and ensures that leased vehicles are maintained at designated and certified workshops approved by the District Transport Bureau |

| Dependency on forest resources (e.g. paper and fixtures) | Dependency | In industries where administrative and sales activities in offices form the basis of operations, business activities inherently require the use of paper and fixtures made from wood grown in forests (printing documents and forms, use in office fixtures, among others) | In the operation of our group's businesses, the use and consumption of paper and office equipment are indispensable for sales and administrative tasks, thereby creating a dependency on natural capital | Paper: Approximately 270 million yen Fixtures: Approximately 130 million yen |

|

List of Climate Change and Natural Capital-Related Risks and Opportunities Recognized by Our Group

We have identified climate change and natural capital-related risks and opportunities relevant to our Group.

As a result of this analysis, the risks and opportunities recognized as having an impact on our business are as follows.

List of identified risks and opportunities

Scenario |

Category |

Changes in Externalities |

Timeframe |

Possibility of Occurrence |

Orico's Risks & Opportunities |

Level of Impact |

Total Impact Value (Sum Within The Period) |

Countermeasures |

|---|---|---|---|---|---|---|---|---|

| Risk of dependency on existing vehicle sales financing based on ownership | Transition Risk | Regulatory changes and evolving consumer preferences accelerate the shift from ownership to usage models like the sharing economy and subscriptions, causing a decline in existing channels | Short-term | High | Decrease in used gasoline vehicle auto loan transaction volume | Medium | Installment credit transaction volume: Approximately - 100 billion yen |

Develop and offer new products and services related to the sharing economy and subscriptions (especially vehicle), such as auto leasing |

| Business continuity risk due to increased extreme weather conditions, such as typhoons and heavy rains | Physical Risk | Increased business continuity risk due to frequent disasters such as typhoons, floods, and among others *: Based on the 4°C scenario |

Medium-term | Medium | Increased business continuity risk in the event of a power outage at our data center, among others | - | Operating revenue: Approximately - 500 million yen (Assuming one day of downtime) |

Support for business continuity during disasters |

| Expansion of the circular economy market | Opportunity (Market) |

|

Short-term | High | Increased demand for personal auto leasing expands our business opportunities, leading to growth in transaction volume and operating revenue | High | Operating revenue: Approximately +38 billion yen |

|

| Formation of a used battery electric vehicle (BEV) market | Opportunity (Market) | The value of used BEVs is properly assessed (market formation), and BEV ownership progresses (consumer behavior change) | Medium-to-long-term | High | As EV battery appraisal methods and lifespan prediction technologies are established, the value of used BEVs can be accurately assessed, advancing the formation of a sound market. BEVs enter the personal auto leasing market and used car market where our Group holds a high share, satisfying financial needs both domestically and internationally, and growing our business. |

- | - | Establish a supply chain centred on batteries, the core of BEVs, with business partners, and develop and provide financial services arising from these channels |

| Expansion of financial needs driven by increased demand for utilization of vacant and other pre-owned housing | Opportunity (Market) |

|

Medium-term | High | Interest in utilization of vacant and other pre-owned housing grows, expanding guarantee opportunities for Akikatsu Loans | Low | Cumulative amount of bank guarantees executed: Approximately +20 billion yen | Drive the promotion of vacant and other pre-owned housing utilization with business partners and expand the market, including guarantees for Akikatsu Loans |

- *The impact value of risks and opportunities is reported as the total from FY2025 to FY2029. However, events that have yet to occur as of the calculation time, July 2025, are excluded from the calculation.

Risk Management

We, Our Group, have established a "Risk Management Basic Policy" to comprehensively understand and manage various risks within the group. Divisions and Groups in charge are entrusted with managing individual risks, while the Risk Management Group oversees the overall management of these risks. To ensure effective control, we has established various committees, including the Comprehensive Risk Management Committee, that monitor and evaluate risks at the management level. The status of risk management across the entire Orico group is regularly reported to the Board of Directors and discussed in Executive Management Meetings.

Risk Management Related to Climate Change and Natural Capital

Our Group does not hold business interests that are directly affected by climate change or natural capital and ecosystems. In addition, we have formulated business continuity plans (BCPs) and conduct BCP training to prepare for emergencies such as large-scale disasters. As such, we recognize that the impact of business continuity risks is limited. However, given the potential impacts of climate change and natural capital-related shifts in the business environment on our operations and society, as well as the rapid acceleration of policy and industry initiatives, we are strengthening monitoring and response through the initiatives described above, under the supervision of the Board of Directors.

Indicators and Targets

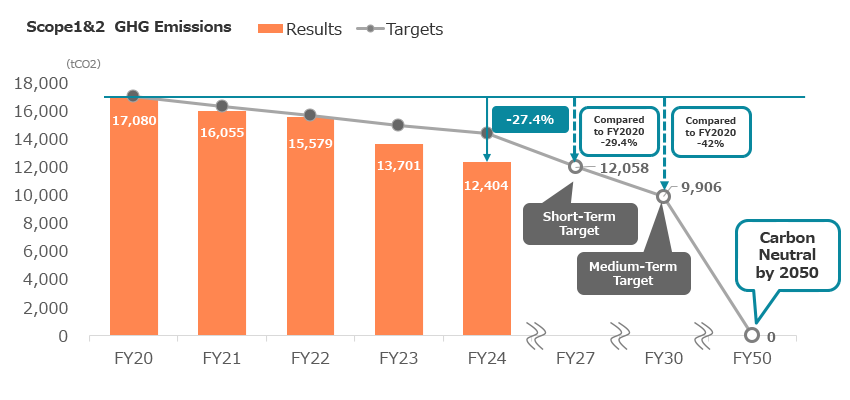

Based on the TCFD recommendations, we are quantifying Scope 1, Scope 2, and Scope 3 emissions as indicators contributing to our understanding of climate-related risks and opportunities. The emissions for the most recent are as follows:

We will continue our reduction efforts to achieve net zero emissions in 2050, with the goal of achieving the 1.5℃ target of the Paris Agreement.

Reduction Targets

unit:t-CO2

| Short-Term Target | Intermediate Target | |||

|---|---|---|---|---|

| FY27 Reduction Targets | Against FY20 | FY30 Reduction Targets | Against FY20 | |

| Scope 1 + Scope 2 (Market-Based*1) |

12,058 | 29.4% reduction | 9,906 | 42% reduction |

| Scope 3 | 182,600 | 17.5% reduction | 166,000 | 25% reduction |

Emissions Results

unit:t-CO2

| Items | Emissions in each year | ||||

|---|---|---|---|---|---|

| FY20 | FY21 | FY22 | FY23 | FY24 | |

| Scope 1 | 4,927 | 4,549 | 4,869 | 4,745 | 4,583 |

| Scope 2(Market-Based*1) | 12,153 | 11,506 | 10,709 | 8,956 | 7,821 |

| Scope 2(Location-Based*2) | 12,119 | 11,160 | 10,092 | 9,803 | 9,587 |

| Scope 1& 2(Market-Based*1) | 17,080 | 16,055 | 15,579 | 13,701 | 12,404 |

| Scope 1& 2(Location-Based*2) | 17,046 | 15,709 | 14,961 | 14,548 | 14,170 |

| Scope 3 Category 1(Purchased Goods and Services) | 7,534 | 5,196 | 4,790 | 4,545 | 5,628 |

| Scope3 Category 2(Capital Goods) | 25,925 | 22,300 | 20,007 | 23,976 | 23,011 |

| Scope 3 Category 3(Not Included in Scope 1 or 2) | 2,605 | 2,279 | 2,065 | 2,735 | 2,657 |

| Scope 3 Category 4(Upstream Transportation and Distribution) | 308 | 449 | 459 | 448 | 437 |

| Scope 3 Category 5(Waste Generated in Operations) | 90 | 83 | 85 | 97 | 102 |

| Scope 3 Category 6(Business Travel) | 1,271 | 1,152 | 1,124 | 1,188 | 1,182 |

| Scope 3 Category 7(Employee Commuting) | 2,654 | 1,953 | 2,116 | 2,367 | 2,584 |

| Scope 3 Category 11(Use of Sold Products) | 537 | 731 | 467 | 614 | 790 |

| Scope 3 Category 13(Downstream Leased Assets) | 180,410 | 0 | 0 | 103,705 | 165,262 |

| Scope 3 Total | 221,333 | 34,143 | 31,114 | 139,675 | 201,653 |

| Total | 238,413 | 50,198 | 46,692 | 153,376 | 214,057 |

- *1: Emissions calculated using the emission factors of electric power companies. However, emissions for domestic and overseas consolidated subsidiaries from FY2020 to FY2023 were calculated using the location-based method described below. GHG emissions for domestic consolidated subsidiaries from FY2024 onwards are calculated using the market-based method.

- *2: Emissions calculated based on emission factors for the entire power system in Japan. For overseas subsidiaries (Thailand, the Philippines, and Indonesia), figures published by the Institute for Global Environmental Strategies (IGES) and the Indonesian Government were used.

- *: The scope of calculation includes Orico and consolidated subsidiaries. In accordance with the GHG Protocol, emissions from Orico Auto Leasing Co., Ltd. and Orico Business Leasing Co., Ltd. are included in Scope 1, 2, and 3 for the base year of FY2020 and from the second half of fiscal 2023, when they became consolidated subsidiaries. Emissions from Orico Product Finance Co., Ltd. are included in Scope 1, 2, and 3 for the base year of FY2020 and from FY2024, when it became a consolidated subsidiary.

Targets and Achievements of In-house Emissions

KPIs related to our Group's transition plan can be found on the following page.

Details on the sustainability KPIs linked to our Medium-Term Management Plan (FY2025-FY2029) are available here.

Assurance Report

To ensure the accuracy and transparency of our energy consumption and GHG emissions data, our group have Independent Assurance Report from an independent third-party organization, SOCOTEC Certification Japan.

FY2024

Area of Coverage : Scope1・2 and Scope3 category2・4・6・7(Area of Coverage is consolidated group)

FY2023

Area of Coverage : Scope1・2(consolidated group)and Scope3 category4・6・7(non-consolidated)