Sustainability

Financial Education and Industry-Academia-Government Collaboration

In cooperation with a diverse range of external stakeholders, including financial education institutions, other educational institutions, and research institutions, we conduct various educational and awareness-raising activities related to finance.

Specifically, we have contributed to enhancing the financial literacy of customers and the youth through actions such as initiatives toward next-generation education, public lectures aimed at the prevention of multiple debts, and disclosure of content for new adults on the website.

Financial Education

Social Collaboration Program with Hosei University

In collaboration with Hosei University, we implemented a "social collaboration program" (extracurricular) from February to March 2024. This program aimed to realize one of our important issues (Materiality)—creating new customer experience value that captures the needs of each and every customer—through financial literacy education that utilizes our unique knowledge. The theme of the program was digital innovation and the creation of new services in the financial industry, and it was conducted over a total of five sessions with students from Hosei University utilizing project-based learning. Each team of students was invited to design the "ultimate payment service" based on a variety of inputs, and made presentations at Orico's head office in the final session.

Their proposals for new services were inspired by problems near and dear to the students and would bring new value to society, such as the digitization of receipts and the development of an application that helps eliminate waiting times for payment at hospitals.

We will continue to leverage a variety of opportunities to develop financial literacy education.

Providing Financial Education Programs Through a Platform

In partnership with ARROWS, Inc., a company that works to solve problems in the education field, we produced a financial education program as teaching materials for high school classes to support consumer education in the wake of the lowering of the legal age of majority.

The content of the program helps high school students become more familiar with finance, proactively face future planning, and promotes a correct understanding of the means to acquire financing. This program is provided to high school teachers nationwide through "SENSEI Yononaka-Gaku", a teacher network operated by ARROWS, Inc., with 99% of high schools in Japan registered.

Participation in the Finance and Career Education Consortium for High School Students

"Commercial Education Consortium Tokyo" is a consortium for providing finance and career education for high school students. It was established by the Tokyo Metropolitan Board of Education in July 2018 as an organization that collaborates with companies and the local community to expand opportunities for students at metropolitan commercial high schools to learn financial knowledge and real-world business practices, and provides necessary classroom support for financial and career education.

Companies, non-profit organizations, universities, vocational schools, and local communities/shopping arcades collaborate with the metropolitan commercial high school to expand opportunities for the students to learn business practices including finance and careers in real-world settings.

We support the Consortium's principles. We participated from fiscal year 2018 to fiscal year 2022, providing and supporting programs such as financial education.

3rd Year Student of Tokyo Metropolitan Daiyon Commercial High School, Year of 2022

1st Year Student of Tokyo Metropolitan Daisan Commercial High School, Fiscal Year 2020/ 3rd Year Student of Daiyon Commercial High School, Year of 2020

2nd Year Student of Tokyo Metropolitan Daigo Commercial High School, Year of 2019

2nd Year Student of Tokyo Metropolitan Daigo Commercial High School, Year of 2018

Participation in Finance Consumer Education Liaison Meeting Organized by the Tokyo Metropolitan Board of Education

In December 2021, the "2021 Finance Consumer Education Liaison Meeting", a meeting organized by the Tokyo Metropolitan Board of Education, was held. Our director and officer participated as a guest speaker.

We conducted online lecture sessions with the aim of providing finance consumer education support to high school students in light of the lowering of the legal age of adulthood. A total of 236 teachers from 192 metropolitan middle schools and high schools attended the session.

We expect that teachers will bring the knowledge and information gained through the session back to their schools and incorporate them into actual classes and activities, thereby contributing to enhancing financial literacy among students.

Financial Literacy Education Regarding Credit Cards

Since 2020, we have conducted financial literacy classes for 5th-grade students at Fujimino City Tsurugaoka Elementary School in Saitama Prefecture, teaching the importance of "credit" and "personal information" and providing a basic understanding of credit cards.

The classes aim to cultivate financial literacy skills, such as wealth management and payment planning, helping students prepare for future credit card usage.

Financial Literacy Web Content for New Adults

With the lowering of the age of majority by the revision of the Civil Code on April 1, 2022, the age at which one can contract for credit cards, among others, without the consent of a parent or guardian became 18 years or older. On the other hand, young people with limited contracting knowledge and social experience can easily become targets for various temptations and malicious traders, and there are concerns regarding the spread of consumer damage among those 18 and 19 years of age.

In response to this concern, we released content on our website, including animations that provide easy-to-understand explanations of the credit card system and precautions for use by new adults and other young adults.

We will continue our efforts to prevent consumer victimization among young people, including new adults, and to raise their awareness of the issue.

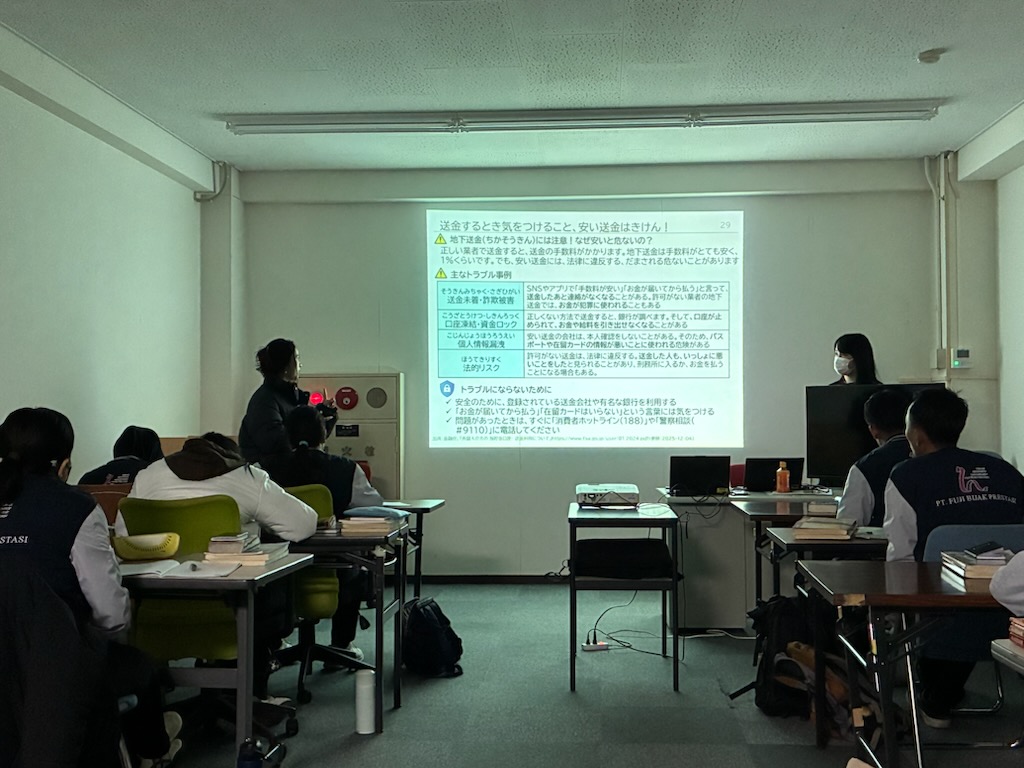

Financial Literacy Education for Foreign Residents Facing Challenges in Accessing Financial Services

We implement educational initiatives aimed at enhancing financial literacy for foreign residents who face challenges accessing financial services, such as insufficient understanding of bank account usage or Japan's financial system.

This initiative aims to promote financial inclusion.

In December 2025, at Techno Center Co., Ltd., a group company of ToYo Work Group Co., Ltd., we conducted a financial literacy course for 15 technical intern trainees. The participants were still catching up on Japan's financial system and the mechanisms of salary and taxation, and had limited opportunities to thoroughly learn sufficient information related to financial literacy.

This course provided foundational knowledge for the safe and appropriate use of financial services, covering how to read payslips, the basics of tax and social insurance systems, methods for managing living expenses, as well as procedures for overseas remittances and preventing related issues. Furthermore, a household budget management workshop was conducted, simulating a month's income and expenditure.

This provided participants with a practical learning opportunity to grasp their own income and expenditure and engage in planned financial management.

We will continue to support and expand assistance for individuals who may be vulnerable to economic disadvantage due to limited understanding of the financial system, and strive to promote financial inclusion through the improvement of financial literacy.

Industry-Academia-Government / Industry-Academia Collaboration

Lecture Held for Students of Kyoritsu Women's University

In January 2025, we held a lecture on the work of our public health nurses and industrial physicians for four students and one associate professor from Kyoritsu Women's University of Nursing. Kyoritsu Women's University of Nursing invites public health nurses and industrial physicians working for companies as lecturers, providing students with the opportunity to learn about the actual work content and roles of public health nurses and industrial physicians, with the aim of giving them a concrete idea of what their careers will be like after they enter the workforce. Through this lecture, the students gained a deeper understanding of the work of public health nurses and industrial physicians.

Dementia Supporter Training Course

IIn December 2024, we held a Dementia Supporter Training Course for employees in cooperation with the Chiyoda Ward Home Support Division, Chiyoda Ward Kagayaki Plaza Counseling Center, and Kyoritsu Women's University of Nursing. The course aimed to help employees learn and practice how to respond when an employee or their family member develops dementia, or when they encounter someone with dementia while living in the local community. More than 70 employees from all over the country participated in the course, and a total of 53 employees working at Orico's head office building in Chiyoda Ward were certified as Chiyoda Ward Dementia Supporters. Going forward, we will continue to regularly hold Dementia Supporter Training Courses, and employees certified as Dementia Supporters will engage in initiatives to support people with dementia in the local community.

Holding a Seminar for Funabashi Residents

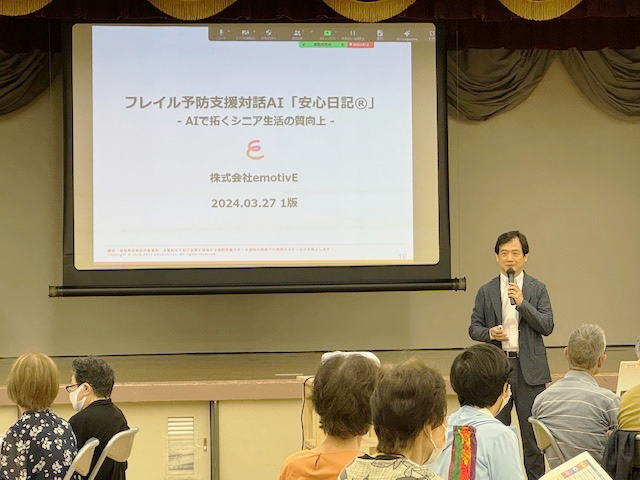

In June 2024, we collaborated with emotivE Inc., Kyoritsu Women's University of Nursing, and Funabashi City to hold a seminar on frailty prevention for Funabashi residents. The purpose of the seminar was to deepen residents' knowledge about living a healthy life, and participants had the opportunity to learn specific information on frailty prevention. We will continue to promote various initiatives through collaboration with local governments, research institutions, and external companies. This seminar marks the Company's first initiative in industry-academia-government collaboration.

Joint Research with Shibaura Institute of Technology

In March 2023, we conducted joint research with Shibaura Institute of Technology and TOPPAN Edge Corporation on web service recognition and UI/UX using eye-tracking and brain-wave measurement. Through this research, we established a new method to analyze whether users are likely to construct unconscious images (mental models) that trigger their actions when they use services.