Sustainability

Improving the Quality of our Services

At Orico, we strive to effectively utilize customer feedback to enhance our products and services. Through initiatives such as Voice of Customer Improvement & Review Working Group, we promote comprehensive and cross-functional efforts. We engage in various activities, including the provision of support through email and chat, checking for fraudulent activities, and monitoring our website. We will continue our efforts to enhance customer support services and strengthen our systems to further improve customer satisfaction.

- Initiatives for Quality Maintenance

- Establishment of Support Structure and Enhancement of Customer Support Services

- Initiatives for Customer Satisfaction Measurement and Improvement

- Stakeholder Dialogue

- Managing Affiliated Stores

- Protection of Children

- Initiatives for Improving Quality of Advertising Service

- Initiatives for Improving New Product Quality

- Initiatives for Improving Financial Access

Initiatives for Quality Maintenance

We implement various initiatives to ensure that customer feedback contributes to maintaining quality by facilitating operational improvements and service enhancements. Specifically, we have established internal procedures for addressing customer feedback. These procedures enable us to respond swiftly and objectively, prioritizing the customer perspective and facilitating effective improvements.

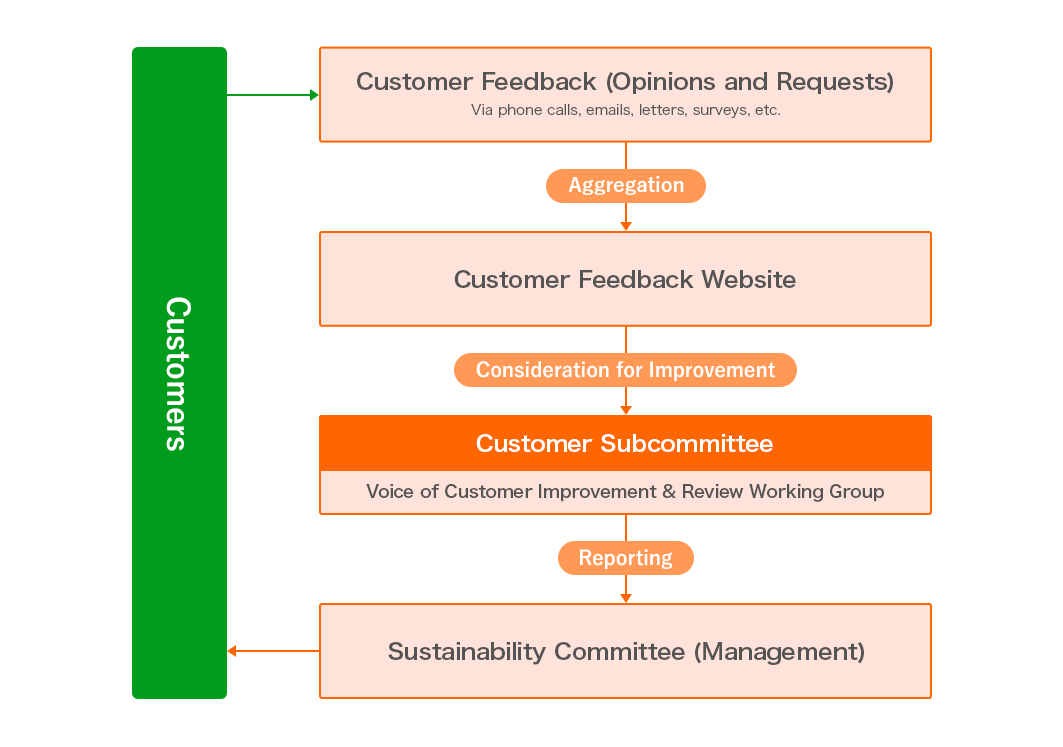

Initiatives to Utilize Customer Feedback

Guided by Customer-Oriented Basic Policy, we sincerely address the opinions and requests received from our customers — our most important stakeholders — and work to improve our services and products. Customer feedback is analyzed and consolidated in our internal database, the "Customer Voice Site". We have established a system in which the CX Promotion Office and the relevant departments collaborate to develop and implement concrete improvement measures.

Furthermore, we share examples of improvements with our customers via the "Responding to Customer Feedback (Japanese Only)" section of our website. By providing transparent information in this way, we strengthen our trusting relationship with our customers.

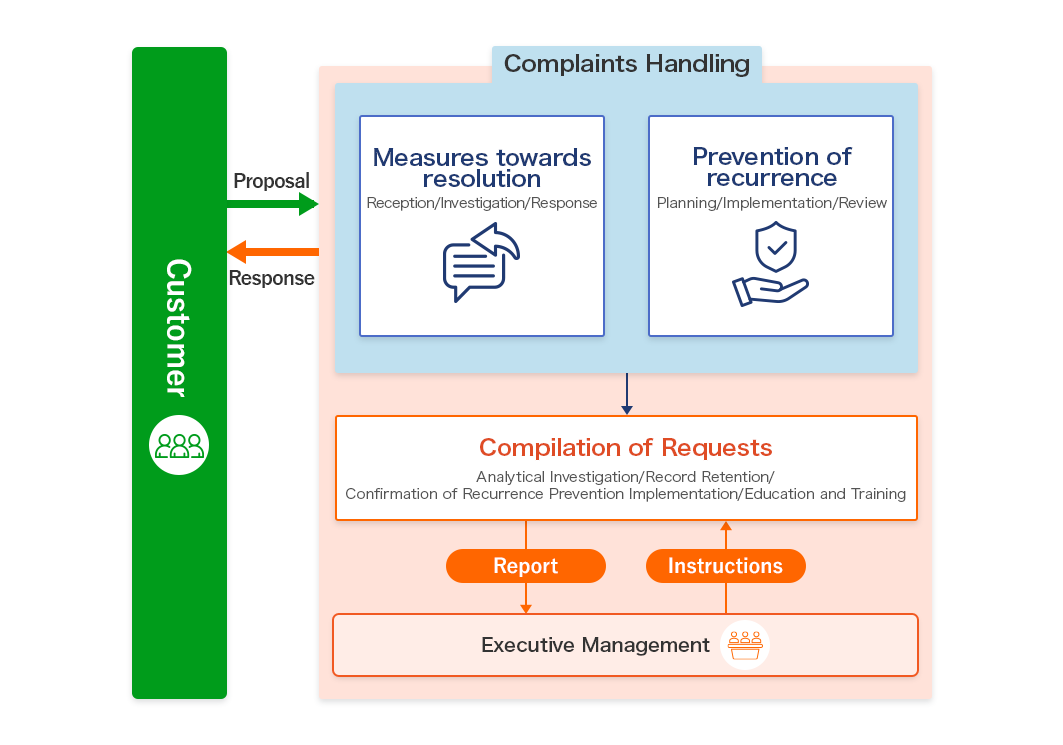

Grievance Management System

We take customer feedback and requests seriously. Our aim is to resolve issues swiftly and effectively, while implementing measures to prevent recurrence and improve our service and operations. When we receive a customer enquiry, we enter its details into our system and document the investigation and response status. Furthermore, the responsible department centrally manages information covering the investigation and resolution process through internal information sharing, from identifying causes to implementing preventative measures. This enables us to verify the appropriateness of the entire complaint handling sequence.

To support these processes, we regularly provide training to enhance the quality of customer service and constantly strive to improve our employees' skills.

Additionally, we regularly report information regarding complaint management to senior management and endeavor to build a more effective complaint management system under their guidance.

Establishment of Support Structure and Enhancement of Customer Support Services

We have created dedicated inquiry contact points for each business segment such as our credit card, installment sales, and rental guarantees businesses. These contact points are staffed by specialized personnel who are ready to assist customers with their inquiries. In addition to traditional support channels like email and phone, we also provide credit card support through chatbots.

In particular, we practice responsible lending for customers facing difficulties based on their income and usage conditions. We provide support tailored to our customers' needs through temporary payment schedule changes and offering alternative products. The requirements for payment schedule changes and alternative products are defined internally to ensure consistent and customer-centric services. To foster a culture of continuously improving skills to better support our customers, we hold an annual nationwide contest called the "Orico Challenge Cup" and award the title of "Grand Master" to those who achieve remarkable results. We also encourage the acquisition of specialized qualifications, such as credit counselors, to strengthen our ability to meet customer demands.

Initiatives for Customer Satisfaction Measurement and Improvement

We aim to enhance customer satisfaction, use customer feedback to improve our operations and create new services using tools such as NPS (Net Promoter Score).

Stakeholder Dialogue

We are committed to ensuring that our sustainability management is of value to a wide range of stakeholders, and we have established opportunities for dialogue with investors, industry groups, peer companies, shareholders, customers, and others.

Managing Member Merchants

We believe it is essential to enhance the quality of our staff's sales activities and establish a healthy relationship of trust with our business partners, including member merchants, to ensure that customers can use our products and services safely and with peace of mind.

When conducting transactions with our business partners, such as member merchants, we verify their management policies, sales products, and sales methods. We also carry out awareness-raising activities and provide guidance on compliance with relevant laws and regulations, as well as on handling personal information and information security measures. We maintain sound business transactions through investigations when entering into new transaction contracts and regular mid-term inspections throughout the duration of the contracts.

To ensure the integrity of our transactions, we conduct various checks during the contract period with our business partners, including those based on legal requirements. We also collaborate with external companies and strengthen our management system through the use of AI for alert management. These digital technologies contribute to the enhancement of our management practices.

Protection of Children

We collaborate with local governments and institutions to conduct various educational activities related to raising awareness in areas related to finance. Specifically, we are working towards enhancing our customers' financial literacy through initiatives such as educational efforts for the next generation, public lectures aimed at preventing multiple debts, and the online disclosure of resources tailored to newly-of-age individuals.

Initiatives for Improving Quality of Advertising Service

We have established The Orico Group Code as our Corporate Philosophy and the code of conduct for the entire group. This code outlines the key points and necessary measures for ensuring the proper operation of our money lending business and establishing the internal systems required to protect the interests of borrowers and others. In this context, we have established guidelines for advertising related to loan contracts, among others, based on the Money Lending Business Act and related laws and regulations, as well as the basic rules for voluntary regulations concerning the business management of the money lending industry set out by the Japan Financial Service Association, while fully recognizing the importance of advertising and marketing. The Orico Group Code stipulates that employees must be careful to ensure that the content and wording of advertisements are fair and do not include false or exaggerated claims or cause social discrimination or human rights violations. Specifically, we conduct training for new employees, training at the time of promotion to management positions, compliance training for different levels of employees, and a compliance seminar for our executives and officers and the executives of our group companies every year to ensure that all employees follow The Orico Group Code. This helps us to carry out responsible advertising, marketing, and promotions that comply with relevant laws and regulations, as well as voluntary rules of the industry.

Initiatives for Improving New Product Quality

We have established a New Business and New Product Committee to evaluate and verify risks related to significant new business ventures and products. The committee is currently chaired by an Executive Officer (Shinya Uda) and consists of members those who are heads of 10 Groups or relevant bodies. The committee's activities are regularly reported to the management meetings.

Initiatives for Improving Financial Access

Enhancing Financial Access through Active Overseas Expansion

We actively expand into rapidly growing Asian markets to enhance the financial access of all. Leveraging the expertise we have cultivated in Japan, we aim to support the realization of a prosperous life for local people and contribute to the development of the communities by providing sustainable financial services that meet the needs of our customers. In addition to our first international venture in Thailand in 2015, we established an additional auto loan company in the Philippines in 2019. In 2021, we acquired an auto loan company in Indonesia, thereby expanding our business networks to include three more countries in Asia. We will continue taking on challenges to provide our financial services to even more people.

Improving Financial Access through Digital Technology

We place great importance on developing human resources who can effectively utilize digital and data, and have created our own DX human resource development program. In the previous Medium-Term Management Plan, we aimed to develop all employees into DX promotion personnel equipped with basic digital technology knowledge and skills, and by March 2023, more than 3,300 employees had obtained certification. Under our current Medium-Term Management Plan, we intend to train 3,000 generative AI-utilizing human resources over the next three years, outfitting them with basic knowledge and skills in generative AI. In addition, we aim to develop 500 citizen data scientists over the next five years who can analyze data to solve problems.

Further, we issued a press release in March 2025 on the AI credit extension review model for corporate clients we developed jointly with Money Forward X, Inc., and this model will provide automatic recommendations on terms and conditions for credit-guaranteed loans. We hope that expanding use of this model will help financial institutions streamline screening operations and improve cash flow by swiftly providing funds to SMEs.